Highlights of the Bank of Canada rate decision

- No change in 0.25% overnight rate, as expected

- Both the global and Canadian economies are evolving broadly in line with the scenario outlined in July

- The rebound in the United States has been stronger than expected, while economic performance among emerging markets has been more mixed

- BOC continues to expect the recuperation phase to be slow and choppy as the economy copes with ongoing uncertainty and structural challenges.

- CPI expected to remain well below target in the near term

- Repeats that BOC "will hold the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved"

As I discussed in the previous review, the EUR did break the upside trendline yesterday but today I found that we got the re-test of the lower diagonal.

Analyzing the current trading chart of EURI found that there is the reaction from buyers and potential for new re-selling.

Watch for selling opportunities on the rallies with the downside target at 1,1710.

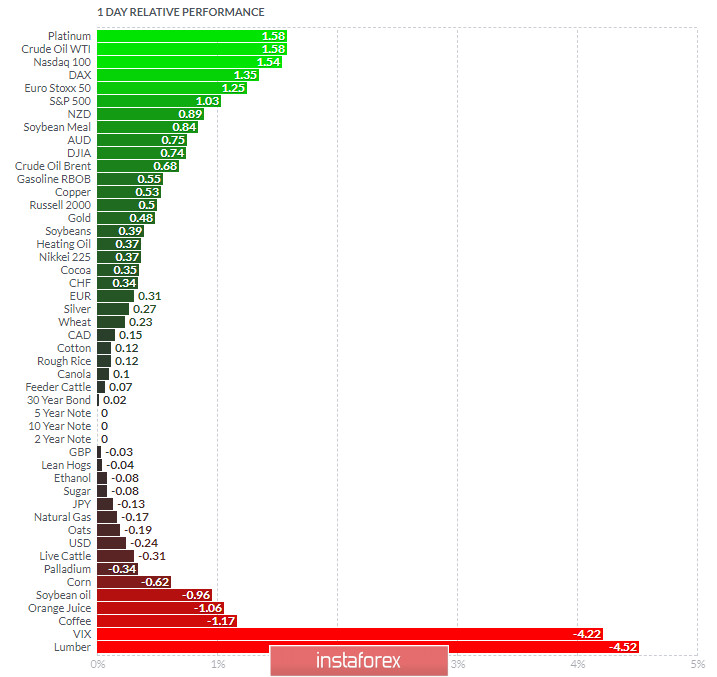

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Platinum and Crude Oil today and on the bottom Lumber and VIX

Key Levels:

Resistance: 1,1850

Support levels: 1,1760 and 1,1710