- Retail sales control group -0.1% vs. +0.3% estimate

- Retail sales ex auto +0.7% vs. 1.0% estimate

- Retail sales ex auto and gas +0.7% vs. 0.9% estimate

- ex auto and building materials 0.5% vs. 1.7%

- ex food services +0.1% vs. 0.5%

- gasoline sales +0.4% vs. July is up 4.4%

- cars/parts sales +0.2% vs. July's -1.0%

- food and beverages -1.2% vs. +0.6%

- furniture +2.1% vs. +0.9%

- sporting-goods -5.7% vs. -5.3% last month

- Gen. merchandise -0.4% vs. -1.1% last month. Department store sales fell -2.3% vs. 2.0% last month

- eating and drinking increased to 4.7% vs. 4.1% last month

Further Development

Analyzing the current trading chart of Gold, I found that the price is still inside of the trading range and that is awaiting for the breakout.

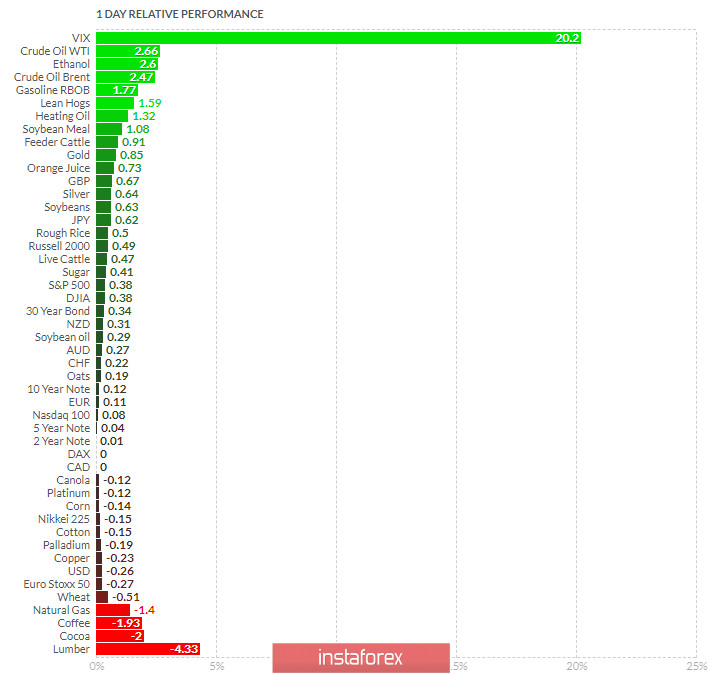

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got VIX and Crude Oil today and on the bottom Lumber and Coffee.

Key Levels:

Resistance: $1,973

Support levels: $1,863 and $1,818.