EUR / USD, GBP / USD

The market did not receive any surprises on Monday.

As mentioned earlier, the US also did not intend to attack North Korea.

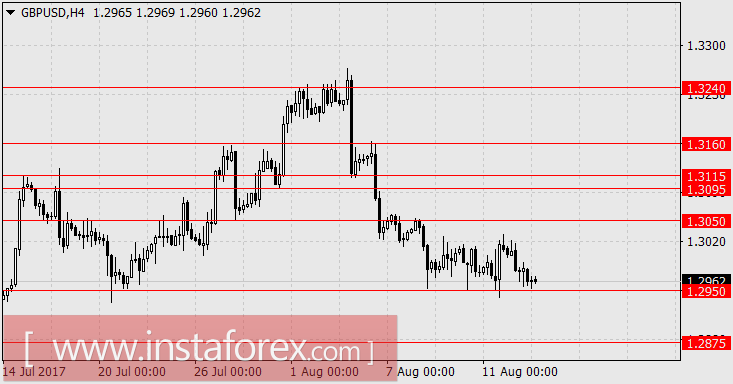

The Industrial production in the euro area for the month of June would likely decline to 0.6% against the forecast of -0.4%. The British pound, with reference to euro and other currencies weakened against the dollar, has postponed the correction for July inflation pressures today. The data will be released at 9:30 AM London time. The basic CPI is expected to grow from 2.4% to 2.5% y/y. The total CPI is expected at 2.7% y/y against the earlier forecast of 2.6% y/y. PPI Input may gain 0.4% m/m and retail prices are expected to remain unchanged at 3.5% y/y. While housing prices may fall to - 4.3% YoY vs. 4.7% YoY in June.

The major news to be released is the US retail sales data at 1:30 PM in London. Basic sales excluding transport are expected to increase by 0.3% in July, the overall sales index is also predicted to grow by 0.3%. The business activity index in the manufacturing sector of New York for the month of August is expected to rise from 9.8 to 10.1. Inventories of companies are projected to boost by 0.4% in June. The business activity index in the US housing market from NAHB for the current month is expected to be unchanged, gaining 64 points.

In addition to the US positive data, the information from the British Institute of Personnel (CIPD) yesterday shows a report on the slowdown in the growth of wages, lagging for inflation by 3 times, which stalled the pound from growing.

In the United States, the head of the Federal Reserve, the Bank of New York, William Dudley spoke, and at the very top of Friday's speech, R. Kaplan and N. Kashkari stated the desire to vote for the FOMC meeting. G.

We are looking forward to the euro at 1.1640 level and the pound sterling at 1.2875 region.

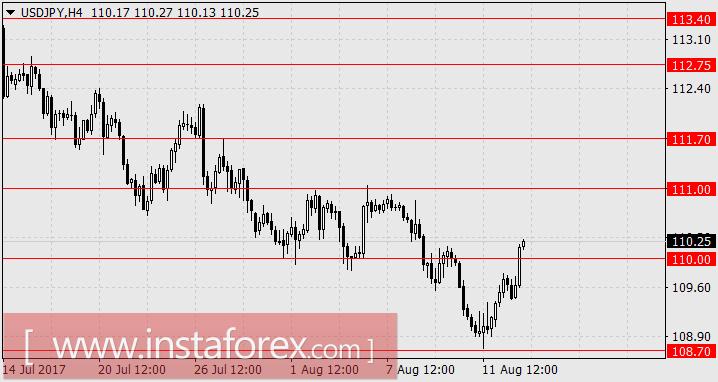

USD / JPY

The Japanese yen did not exacerbate the situation in the North Korean conflict, turned from supporting the June lows.

Industrial production for June showed an expansion of 2.2% against 1.6% estimate, capacity utilization increased by 2.1%.

With such economic indicators, the intervention of the Bank of Japan is no longer necessary for the sluggish growth of the yen. We look forward to the rapid growth of the pair towards 111.00, 111.70 and to 112.75.