The first thing that needs to be focused today is the UK inflation, which should rise from 2.6% to 2.7%. The recent slowdown in inflation was the reason for the decline in the number of supporters of the hike in the interest rate in the BOE. However, this does not mean that this idea was abandoned. If the forecasts are justified, then the chances of raising the interest rate this year will significantly increase. Naturally, this will positively affect the pound.

In the second half of the day, data on retail sales in the US will be released, which can change the overall picture of the day. It is forecasted that the growth rate of retail sales will accelerate from 2.8% to 3.0%, which will offset the slowdown in inflation and give the dollar more optimism.

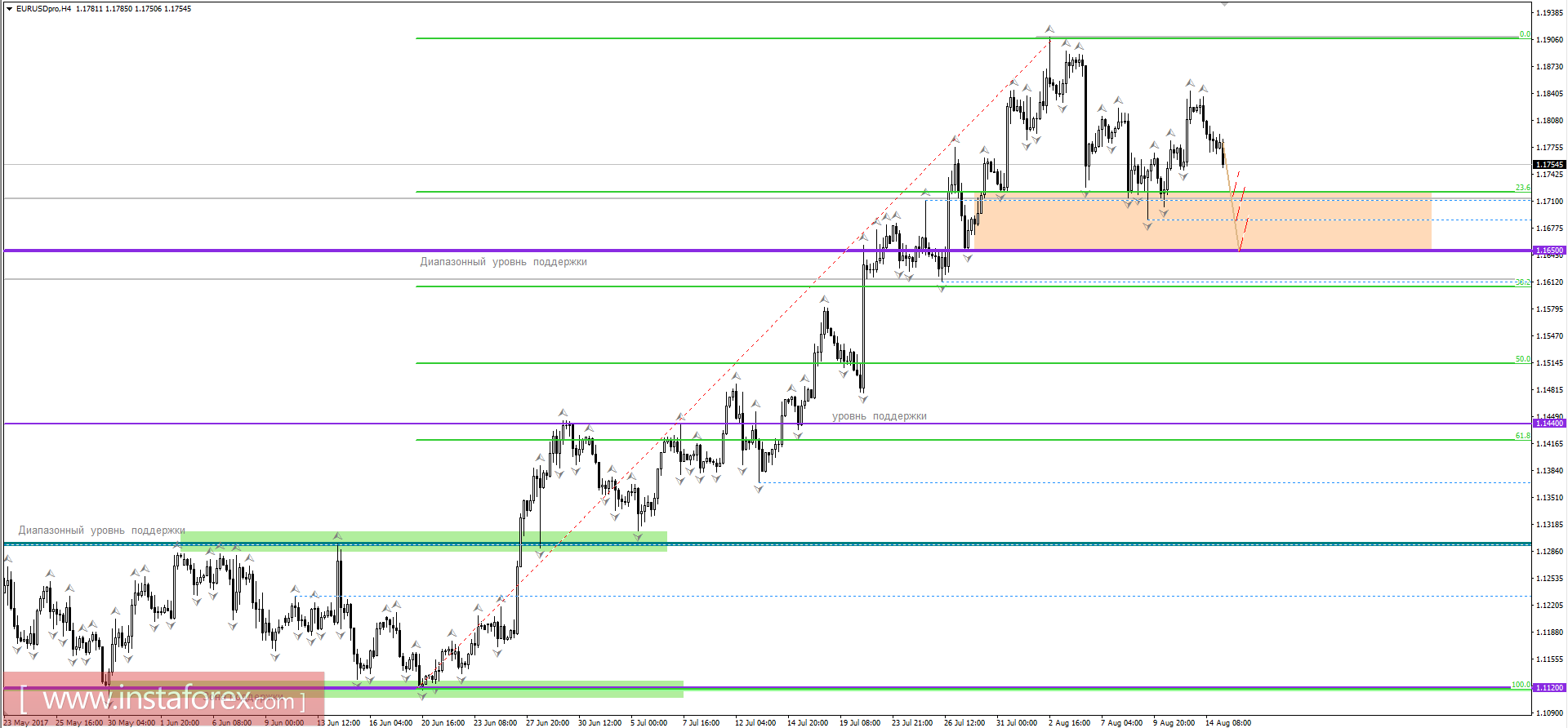

The euro/dollar currency pair is likely to once again converge with the value of 1,1715, and return the range of the band level of 1.1650 / 1.1720.

The currency pair pound / dollar continues to fluctuate in flat 1.2950 / 1.3020. It is probable that the support level with the movement to 1.3000 / 1.3020 will be tested, with a return to 1.2970 / 1.2950.