GBP/JPY

The players on the fall managed to get support (weekly Kijun 141.83 + monthly Tenkan 142.00) and close the day below the minimum extremum. The downward reference points have not changed. The nearest support is the weekly Fibo-Kijun (140.35), but the more important and fortified target zone is now lower, it is formed by the aim of breaking the daytime cloud (139.84-138.96) and the week-long Senkou Span A (139.24).

The goal for the H1 cloud breakdown was worked out and left behind, as a result, the benchmarks for lowering on the lower halves were over, all attention to the support of the older time intervals (the nearest 140.35). Among the resistance today is 141,30 (Tenkan N4 + Kijun N1) - 141,83-142 (Kijun N4 + cloud N1 + high-time levels) - 142.48 (the lower boundary of cloud H4 + day Tenkan).

EUR / JPY

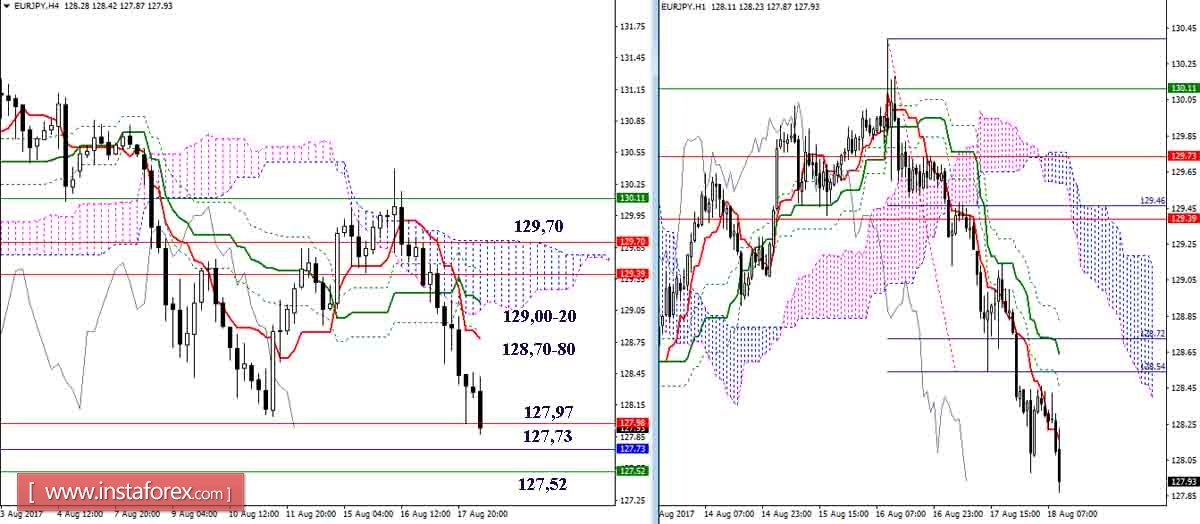

The rebound, formed when testing the final frontier of the day cross (Fibo Kijun 130.11), allowed the bears to continue their decline. To date, the pair has descended to the support of the daytime cloud (Senkou Span A 127.97), strengthened by the monthly Fibo Kijun (127.73) and the weekly Tenkan (127.52). The further development of the situation now depends on the result of the euro / yen's interaction with the supported support.

The goal for the breakdown of the H1 cloud is worked out and punched. The pair continued its decline and has now reached a rather wide support zone (127.97-73-52), formed by the levels of the older time intervals. The task of players to go down is to overcome the supported supports, but the strength of any level can now serve as the basis for the formation of inhibition or an upward correction. Among the resistance of the lower half, today it is necessary to note 128,70-80 (Tenkan N4 + Kijun N1) - 129,00-20 (Kijun Н4 + cloud Н4) - 129.70 (Senkou Span B Н4).

Indicator parameters:

All time intervals 9 - 26 - 52

The color of the indicator lines:

Tenkan (short-term trend) - red,

Kijun (medium-term trend) - green,

Fibo Kijun - green dotted line,

Chinkou - gray,

Clouds: Senkou Span B (SSB, long-term Trend) - blue,

Senkou Span A (SSA) - pink.

The color of the additional lines: support and resistance MN - blue, W1 - green, D1 - red, H4 - pink, H1 - gray,

Horizontal levels (not Ichimoku) - brown,

Trend lines - purple.