The firm says global recovery has been significantly faster in Q2 and Q3 than previously estimated

- Global GDP level is about half way back to pre-virus levels

- Forecasts global GDP for 2020 at -3.9% (previously -4.5%), 2021 at +5.6%

But they do warn that the debt expansion and potential asset overvaluation poses a 'serious risk of a looming global financial crisis' should central banks start to shift away from easy policy measures that are in place currently.

That said, I would argue that central banks will risk no such thing over the next 3-5 years. As soon as the market kicks and screams, you can always count on central bank policymakers to pacify the market and keep the party going.

As I discussed in the previous review, the EUR managed to sell off from the resistance trend line as I expected.

Further Development

Analyzing the current trading chart of EUR, I found that sellers got total control today and that EUR is heading towards our first downward target at 1,1740. Second downward target is set at 1,1700 and third at 1,1630.

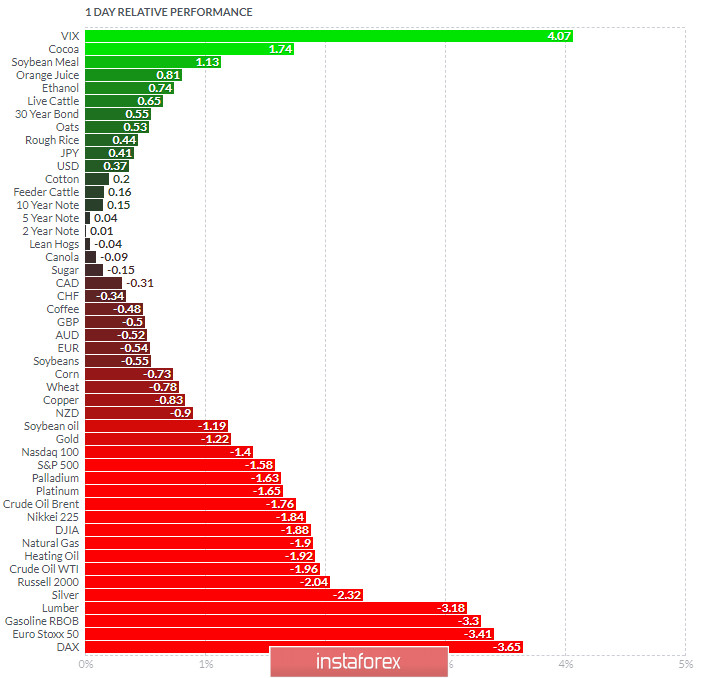

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got VIX and Cocoa today and on the bottom Dax and Gasoline RBOB.

EUR is on on the negative territory and got strong downside momentum.

Key Levels:

Resistance: 1,1870

Support levels: 1,1740, 1,1700 and 1,1630