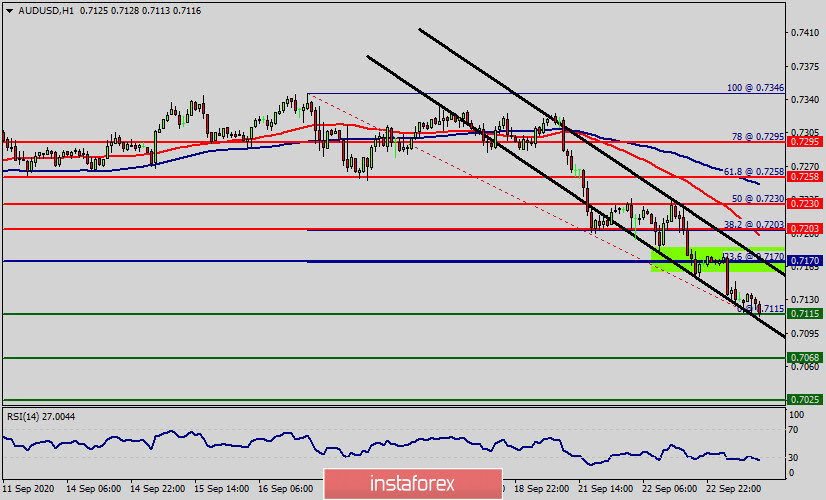

On one-hour chart, the AUD/USD pair is continuing in a bearish market from the resistance levels of 0.7203 and 0.7170.

Also, it should be noted that the current price is in a bearish channel. Equally important, the RSI is still signaling that the trend is upward as it is still strong above the moving average (100) since yesterday.

Immediate resistance is seen at 0.7203 which coincides with a ratio 38.2% of Fibonacci.

Consequently, the first resistance sets at the level of 0.7170. So, the market is likely to show signs of a bearish trend around the spot of 0.7170.

Pivot point is coincides with the first resistance at the point of 0.7170. In other words, sell orders are recommended below the pivot point (0.7170) with the first target at the level of 0.7100.

Furthermore, if the trend is able to break through the first support level of 0.7100. As a result, the pair will drop towards next objective (0.7068) to test it.

The trend is still calling for a strong bearish market from the spot of 0.7100. It is possible that the pair will turn downwards continuing the development of the bearish trend to hit the targets of 0.7068 and 0.7025.

Notice that sellers are asking for a high price. Please check out the market volatility before investing, because the sight price may have already been reached and scenarios might have become invalidated.

However, stop loss has always been in consideration thus it will be useful to set it above the last double top at the level of 0.7230 (notice that the major resistance today has set at 0.7230).