Overview:

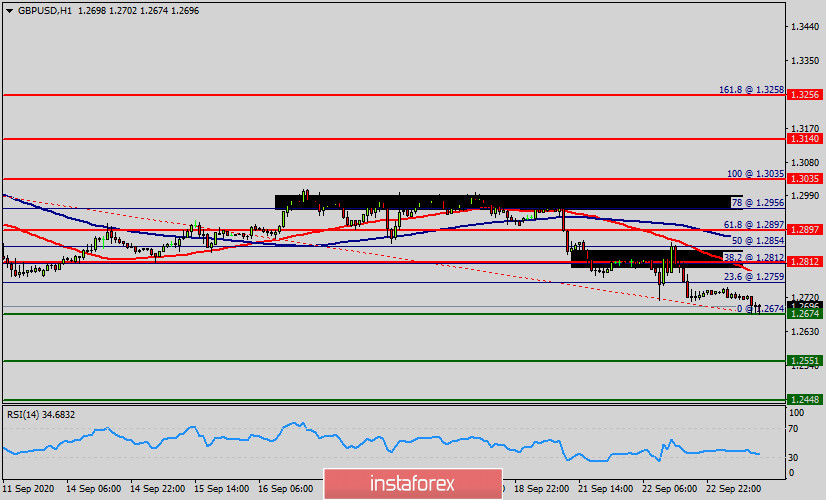

- Yesterday, the GBP/USD pair reached a new minimum at the price of 1.2712. So, today the price may reach one more minimum around the spot of 1.2674, which coincides with the ratio of the double bottom. Today, the GBP/USD pair is challenging the psychological resistance at 1.2812. Hence, the resistance is seen at the level of 1.2812 in the one-hour time frame. We expect the GBP/USD pair to continues moving in a downtrend below the level of 1.2812 towards the first target at 1.2551, while major resistance is found at 1.2897 (61.8% Fibonacci retracement levels). On the downside, a clear break at the level of 1.2674 could trigger further bearish pressure testing 1.2551, which represents the major resistance today.

Forecast:

- As a result, it is gainful to sell below this price of 1.2812 with targets at 1.2650 and 1.2551. However, the bullish trend is still expected for the upcoming days as long as the price is above 1.2551.

Daily Technical level:

- Major resistance: 1.3035

- Minor resistance: 1.2897

- Intraday pivot point: 1.2812

- Minor support: 1.2674

- Major support: 1.2551

Analysis tip:

- If the trend is be able to hit the daily pivot point (because of a market bounce in next day), it will of the wisdom to sell as the we did on the weekly strategy. Sometimes, it uses in a daily trade to stop long position and open a new short position. It should be noted that we combine the daily pivot point, weekly pivot point strategies and sentiment analysis to trade.