JP Morgan is reportedly planning to move about €200 billion from the UK to Frankfurt due to Brexit and plans to finish the migration by the end of the year, Bloomberg reports citing people familiar with the matter.

The shift will see the firm become Germany's sixth-largest bank - based on assets at least.

The sum is rather substantial and if anything, may be a tailwind for EUR/GBP flows in general - should there be any material FX transactions coming out of this.

But in any case, it only adds to the headwinds - even if just a little - for the pound at the moment amid pressure from Brexit talks, rising virus cases, economic recovery slowing with a lack of fiscal support, and potentially negative rates by the BOE

As I discussed in the previous review, the EUR managed to start new downside cycle as I expected and the price is heading towards the level of 1,1625.

Further Development

Analyzing the current trading chart of EUR, I found that there is still more potential for the downside and potential test of 1,1625. Seems like that 4H time-frame is on the bear flag, which is another confirmation for the downside movement.

IN the background, I found that there is the breakout of the trend line (Tl), which is another confirmation for the downside movement.

Watch for selling opportunities on the rallies with the target at 1,1625.

Resistance is set at the price of 1,1735

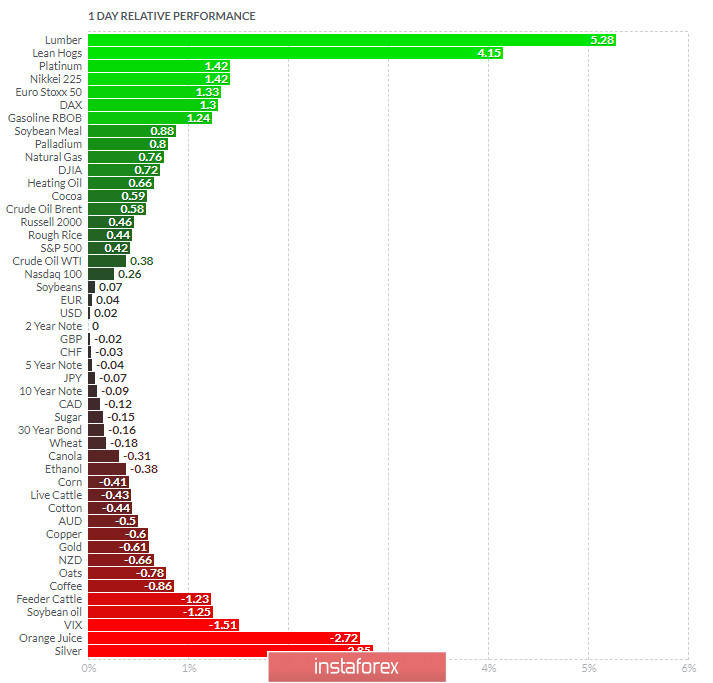

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Lumber and Lean Hogs today and on the bottom Silver and Orange Juice

EUR is neutral on the list.

Key Levels:

Resistance: 1,1735

Support level: 1,1625