US durable goods orders for August

Prior was +11.4% (revised to +11.7%)

- Durables ex transportation +0.4% vs +1.0% expected

- Prior ex transportation +2.6% (revised to +3.2%)

- Capital goods orders non-defense ex-air +1.8% vs +1.0% expected

- Prior capital goods orders non-defense ex-air +1.9% (revised to +2.5%)

- Capital goods shipments non-defense ex-air +1.5% vs +0.8% expected

- Prior capital goods shipments non-defense ex-air +2.4% (revised to +2.8%)

As I discussed in the previous review, the EUR is still in the strong downward cycle and I see no evidence of any reversal yet.

Further Development

Analyzing the current trading chart of EUR, I found that sellers are still in control and tat EUR managed to hit my yesterday's target at 1,1625. The next downside target is set at the price of 1,1545

Watch for selling opportunities on the rallies with the target at 1,1545. The main cause of the most recent drop on EUR was the breakout of the rounding top formation in the background.

My advice is still to watch for selling opportunities with the target at $1,818

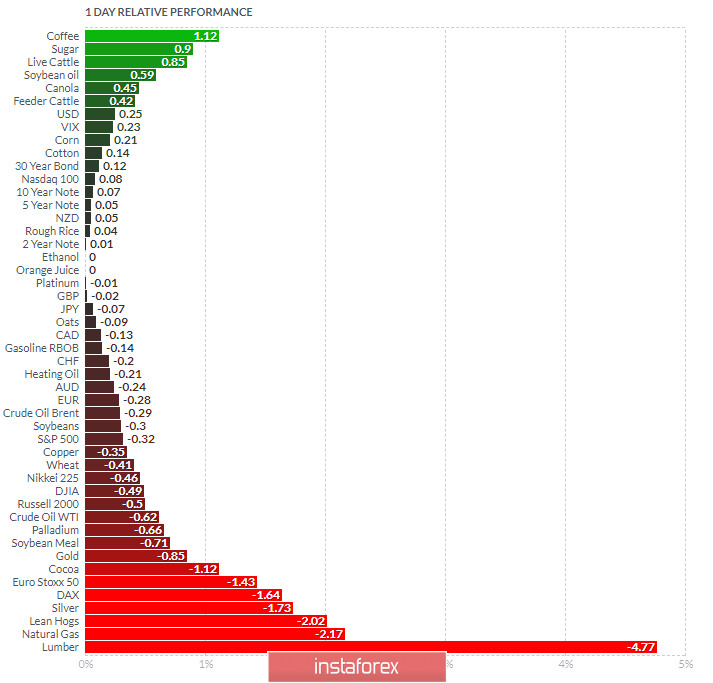

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Sugar and Live Cattle today and on the bottom Lumber and Lean Hogs.

EUR is on the negative territory....

Key Levels:

Resistance: 1,1690

Support level and downside target: 1,1545