Overview :

The AUD/USD pair is the Forex ticker that shows the value of the Aussi against the US Dollar. The AUD/USD pair on major support (0.7007), prepare for a bounce in coming hours.

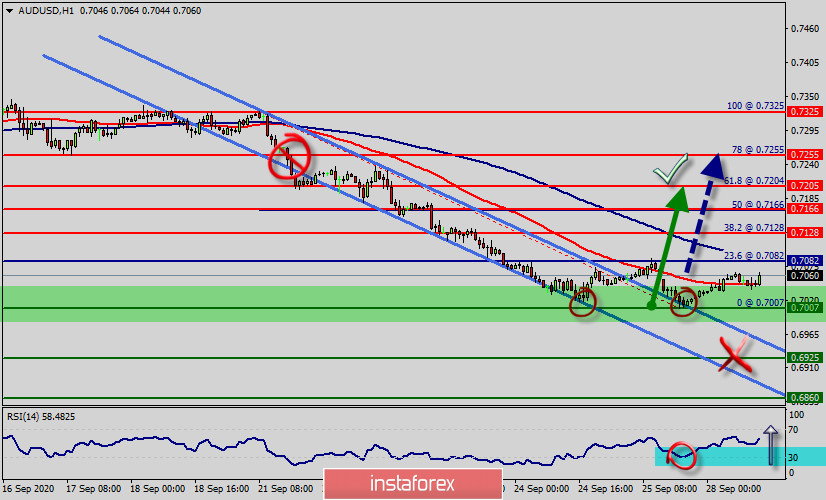

Price is testing major support at 0.7007 (the double bottom, horizontal overlap support) and a strong bounce could occur at this level to push price up to at least 0.7082 resistance (23.6% of Fibonacci retracement, pivot point).

The AUD/USD pair touched our buying level and reversed perfectly around the spot of 0.7007 - 0.7080. We remain bullish below our buying area major support at 0.7007.

The RSI (14) indicator sees a bullish exit of our ascending bottom-turned-support line signalling that we will likely be seeing some bullish momentum from the bottom of 0.7007.

Price has risen strongly towards our profit target as expected. We prepare to buy above major support at 0.7007 for a rebound up to at least 0.7128 resistance.

It should also be noted that the trend will be able to break through the both of moving average (50 and 100) so as to call for new bullish wave. While moving averages are useful enough on their own, they also form the basis for other technical indicators such as the moving average convergence divergence (MACD).

Trading recommendations :

The AUD/USD pair is showing signs of strength following a breakout of the lowest level of 0.7007. So, buy above the level of 0.7007 with the first target at 0.7128 in order to test the daily resistance 1. The level of 0.7205 is a good place to take profits. If the trend is able to break the level of 0.7205, then the market will call for a strong bullish market towards the objective of 0.7325 this week. On the other hand, in case a reversal takes place and the AUD/USD pair breaks the support level of 0.7000, a further decline to 0.6860 can occur. It would indicate a bearish market.

Conclusion :

- We foresee a rebound from the zone of 0.7007 with uptrend movement towards the targets of 0.7082, 0.7128, 0.7225 and 0.7325.

- Weekly range expected : 0.7000 - 0.7325.