Comments by BOE chief economist, Andy Haldane

Any decision on negative rates would depend on cost-benefit analysis

- Work on negative rates likely to take months

- Commentators have interpreted the start of work on negative rates as conveying signal about likelihood of introducing them in the near-term

- BOE minutes contained no such signal

- BOE committed to keep borrowing costs at extraordinary low levels

- Economy has recovered faster than anyone expected

- Positive news have received less attention than it deserves

- Overly pessimistic narrative risks becoming self-fulfilling

As I discussed in the previous review, the Gold managed to complete the upside correction and reject from our key pivot resistance at $1,899

Further Development

Analyzing the current trading chart of Gold, I found that the buyers got exhausted today and the downside rotation is on the way towards the level at $1,848. In my opinion, the Gold finished the ABC correction and it is ready for the new leg down...

The main cause of the most recent downside cyle on Gold is the breakout to the downside of the symmetrical triangle pattern in the background.

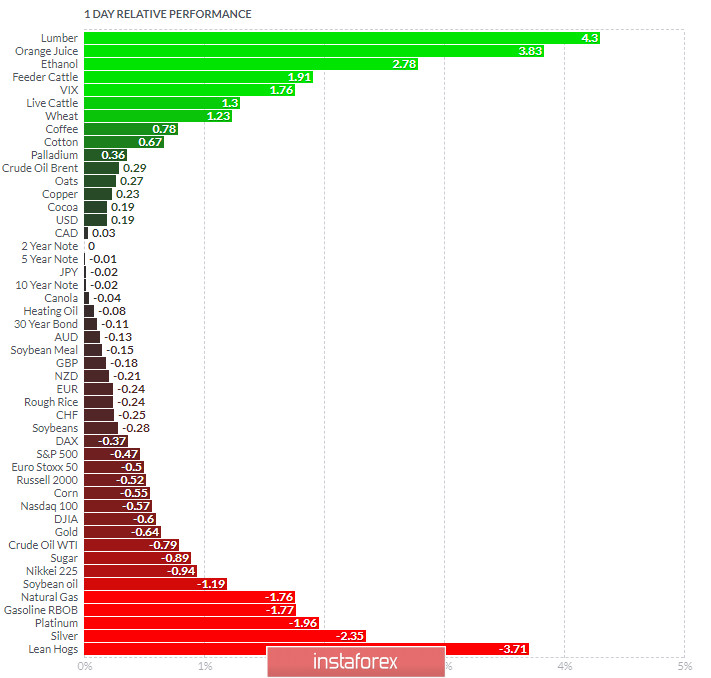

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Lumber and Orange Juicer today and on the bottom Lean Hogs and Silver.

Gold is the negative territory today, which is another sign that sellers are in control.

Key Levels:

Resistance: $1,899

Support level: $1,848