Recently, they have tried to push the 'symmetrical' narrative on their inflation outlook/mandate but then Lagarde tried to make some inroads to 'average' inflation targeting - similar to the Fed - earlier in the week here.

As much as the ECB wants to try to build a similar narrative as the Fed, let's be real. It'll be good work if they can help price pressures recover fromthe lows seen today, but to consistently overshoot 2% for a period of time? That's nothing but a pipe dream.

As I discussed in the previous review, the Gold managed to keep the upside pressure and in my opinion, there is the room for further upside swing to develop.

Further Development

Analyzing the current trading chart of Gold, I found that the buyers are in control and that you should watch for buying opportunities on the dips.

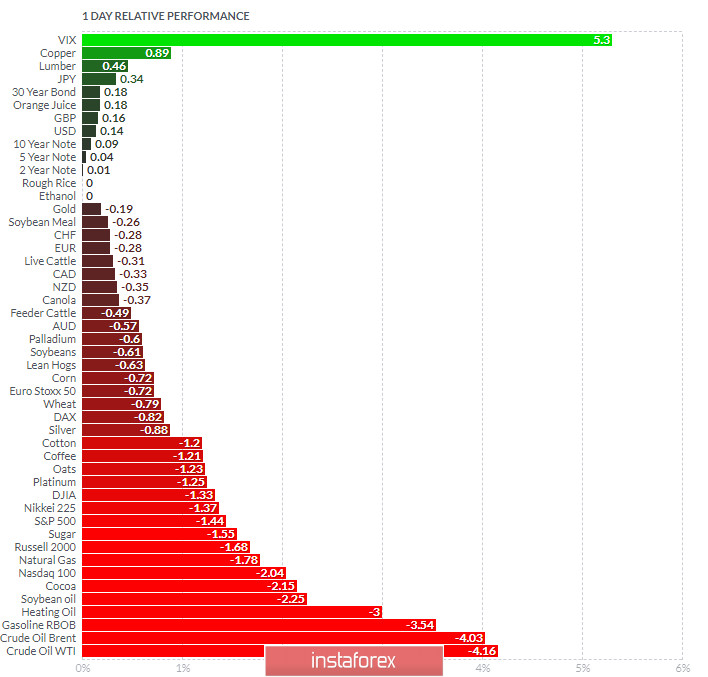

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got VIX and Copper today and on the bottom Crude Oil and energry sector.

The Gold neutral on the relative list and is waiting for the Non-Farm Employment Change numbers.

Key Levels:

Resistance: $1,920 and $1,936

Support levels: $1,905 and $1,890