EUR / USD, GBP / USD

Yesterday, the decline of the euro, pound, and other currencies have had a reversal that the market has been waiting for so long. There has been a mistake in the initial reaction of the market to the news about the beginning of a 10 billion dollar reduction in the balance sheet every month. The market immediately began to fall, but this only confirms the speculative and "immature" nature of the growth of the euro and the pound in recent weeks. Before the release of the announcement, the currency was rising and the British pound reflected the highest growth because of excellent dynamics in retail sales. The index for August showed an increase of 1.0% against the forecast of 0.2% while the report for July revised up from 0.3% to 0.6 %. On an annual basis, it advanced 2.4% compared to 1.4% earlier. The pound appreciated more than 150 points on the data, which induced an optimistic mood from middle-class investors before the decision of the Fed. The movement of euro was limited but remained optimistic during the first half of the day as it grew by 38 points. It seems that the major players were preparing to turn the market for today and be against to the meeting of the ECB on September 7. The excitement was fueled by the former head of the Fed, Ben Bernanke, who declared the "extreme danger" of reducing the balance in general. He suggested that it would increase from the current 4.5 trillion dollars to 5.6 trillion.

The real optimism was demonstrated in the stock market. After a downward reaction to the news from the Fed, the indices fell slightly but the closing of the day was still positive with 0.06% for S&P 500 and 0.35% for Russell 2000. This was mainly because of the Fed as it raised its forecasts for the economy and lowered its rates. The GDP forecast for the current year increased from 2.2% to 2.4%. According to the inflation, the expectation of achieving the 2.0% target rate was set aside for 2019 while the long-term consensus forecast was lowered from 3.0% to 2.8%.

The long-running political crisis in Spain flared up. Fourteen ministers of the Catalan government, who aimed to repress the new referendum on independence, were arrested by the police. Nearly all heads of cities and municipalities of Catalonia estimated more than 700 people are under investigation.The law was adopted on 19 October with the reason of holding a referendum on October 1.

There are risky correlations with the decline of the dollar against the background of the stock market growth which can be considered complete. The traditional mutual influences such as the strengthening of the dollar with the growth of the stock market will be further considered.

British investors can now fully concentrate on political developments around Brexit. On Friday, Theresa May will speak to the E.U. about the concept of "Brexit". The focus of her speech may lead to the resignation of Foreign Minister Jones. Today, ECB president Mario Draghi gives a welcome speech at the conference focused on systemic risks while he will have a talk with students in Dublin tomorrow. There are no expected monetary policy statements from him.

Macroeconomic indicators are expected to be neutral today. Net borrowings of the public sector from the U.K. is forecasted to increase 6.5 billion pounds for applications on unemployment benefits from 284,000 to 300,000 and a decrease in the index of business activity in the manufacturing sector of Philadelphia from 18.9 to 17.3.

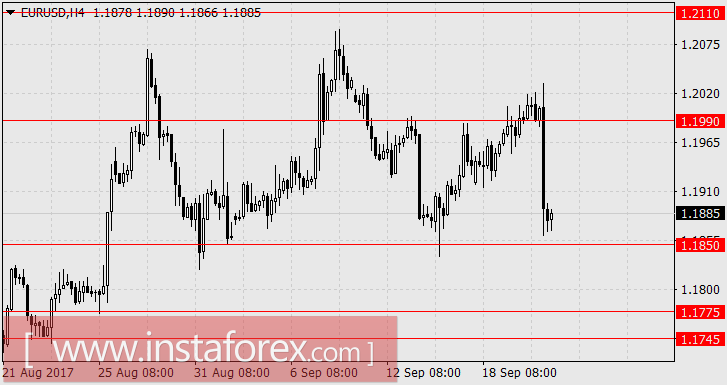

The euro is anticipated to be traded in the range of 1.1745 / 75 while the pound sterling in the range of 1.3380-1.3400.

AUD / USD

The Australian dollar followed the decline of the greenback in the past two days. Yesterday, investors ignored the 0.1% decline in the leading indicators index from MI, as well as the New Zealand. Today, the country is experiencing a lost opportunity for growth as New Zealand's GDP data for the 2nd quarter showed an increase of 0.8% after the revised 0.5% to 0.6% of the data for the first quarter.

Naturally, the commodity market fell after the movement of the dollar where the iron ore was down by -1.05%, copper -1.06%, nickel -1.96%, and coal -0.3%. The stock market of Australia lost 0.91% in the Asian session due to the decline of commodity and agricultural companies against the background of growth in Chinese and Japanese indices.

Next week, there is no expected economic news from Australia. The relationship with the US dollar gets stronger. The AUD/USD pair is presumed to decline towards 0.7870.