The euro/dollar pair began the trading week with a significant decline. The market reacted to the parliamentary elections in Germany, which took place yesterday. At the moment, 100% of ballots have been processed, so it is safe to talk about political structures in a strategically important state for the EU.

Nominally, Angela Merkel surpassed her rivals, and, most likely, will become the Chancellor for the fourth time. But the press has already dubbed this victory a "failure", which all in all reflects the essence of what is happening. For the entire period of her political career, this is the worst result for the party she leads. Actually, Merkel herself acknowledged this in her welcoming speech: despite her official leadership, her political power received a very alarming call.

Generally, traders were frightened not by this fact. Elections showed that electoral preferences are changing in Germany, and these changes are not in favor of European integration. Increasing popularity of ultra-right political forces, strengthening anti-immigration rhetoric, and increasing the role of nationalist ideas - all these are dominant than the prospect of the development of the European Union. To understand the general viewpoint, let's compare the results of yesterday's and the previous German elections.

So, in 2013, the results of the elections looked like this: the Christian Democratic Union - 37.2%; Social Democratic Party of Germany - 29.4%; "Left" - 8.2%; "Green" - 7.3%; The Christian Social Union - 8.1%; "Alternative for Germany" - 1.9%. Angela Merkel's party received the best result of the bloc in the last 20 years (although for an absolute majority it did not have only 5 seats), and it formed a coalition government without any difficulties.

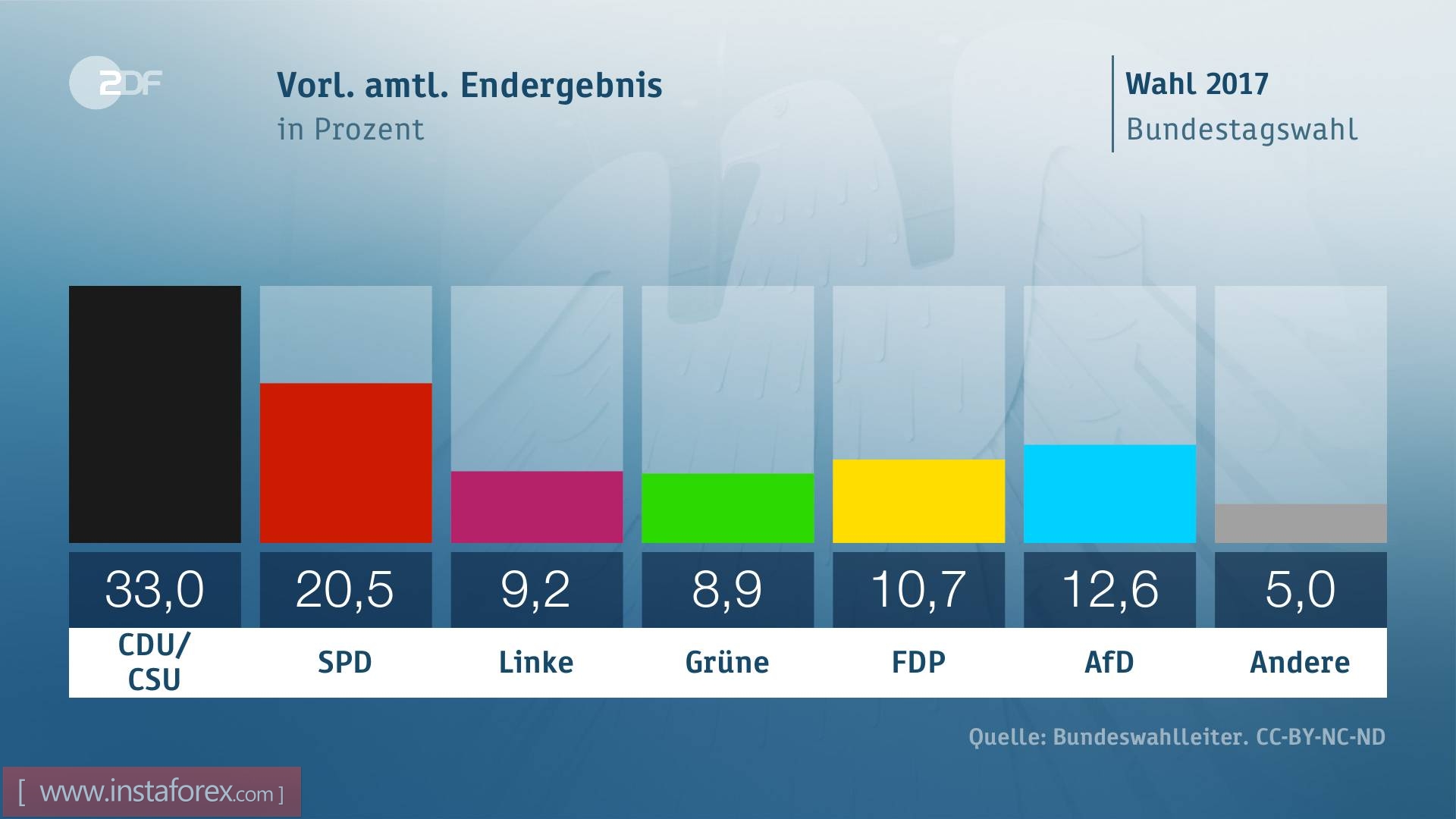

But how do the preliminary results of the German elections-2017 look like? About 33% of voters voted for the CDU/CSU block, 20.5% of voters supported the Social-Democratic Party of Germany, while the third-place right-wing "Alternative for Germany" received 12.6% of the total votes. After the nationalists followed the liberal Free Democratic Party of Germany - 10.7%, "Left" - 9.2% and "Green" - 8.9%.и» – 12,6% голосов. После националистов следует либеральная Свободная демократическая партия Германии – 10,7%, «Левые» – 9,2% и «Зеленые» – 8,9%.

Naturally, the main development of the last parliamentary elections is the incredible success of the ultra-right. For four years, they have increased their positions by tenfold and managed to get into parliament, reflecting the prevailing sentiment in the society. For the most part, this is the Germans' response to Angela Merkel's "open doors" policy, when over a million years more than a million migrants entered the country. In turn, the representatives of "Alternative Germany" do not only advocate a tightening of migration policy (up to deportation), but is an also advocate for the country's withdrawal from the European Union. Therefore, the anxiety of traders of the EUR/USD pair is quite understandable, when a party with such views takes the third place in the parliamentary elections.

However, these alarming concepts did not provoke a large-scale fall of the pair. The price dropped to the middle of the 18th figure and froze in place, reinterpreting the latest events. And in my view, the results of the German elections will not be able to unfold the pair, despite all the investors' sentiments.

Now the market is under the influence of loud and fear-arousing headlines, the essence of which boils down to the fact that radical right-wing forces for the first time since the time of Hitler were in Bundestag. However, if you do not give in to unnecessary emotions and look at the situation impartially, then the reasons for panic will be much less. Yes, Merkel has lost about a hundred seats in parliament and she will have to look for political allies. In 2013, she also failed to independently secure the majority, missing five seats. And she also had to negotiate with political opponents.

At the moment, there are two options for a coalition agreement. First of all, there is the talk about the preservation of a big coalition of the CDU/CSU with the Social Democrats. According to other data, the Bundestag will conclude a tripartite union between the CDU/CSU, the "Green" and the "Free Democrats". It should be noted that none of the configurations implies the participation of "Alternative Germany". Representatives of this political force can not get into the government and will not be able to influence the legislative process. All things considered, the ultra-right has received in the form of parliament a powerful platform for its PR and building up its political power, but no more.

In addition, do not forget that the wave of popularity of right-wing forces swept the whole of Europe, and Germany was no exception. In France - this is Le Pen and its "National Front", in Britain - UKIP, in Italy - "The Movement of Five Stars", in Greece - "Golden Dawn" and so on. Ideas of former political outcasts have become popular against the backdrop of a million flow of illegal migrants and a never-ending terrorist threat. But, despite the increased popularity, ultra-right political forces could not enlist the support of an overwhelming number of voters to have a "controlling stake" in parliament and government. The same goes for Germany.

Thus, the main threat now for traders of the euro/dollar pair is not the victory of "Alternative Germany", but the risk that the remaining political forces will not be able to agree on the creation of a coalition. In this case, Germany is waiting for new parliamentary elections, and the country will be in a state of political instability. This will put significant pressure on the euro - in pairing with the dollar the currency will weaken to at least 1.1710 (the upper limit of the Kumo cloud on the daily chart). But if a political compromise is found, the price will continue its upward direction to the first price target 1.2030 (the top line of the Bollinger Bands indicator on D1).

In other words, the fate of the euro/dollar pair now depends on the negotiability of German politicians.