The US dollar continues to recover across the market, winning back its lost positions. Among all the dollar pairs, only the yen tried to resist, however, it surrendered today under the pressure of the American currency. It is noteworthy that yesterday, the dollar was completely dismissed due to the weak indicator of consumer confidence in the US, and the disappointing data on the property market as the index of sales of primary housing for the second month failed to exit negative territory.

The market placed its focus on the speech of the head of the Federal Reserve, Janet Yellen. It is worth noting that it surpassed all expectations, despite the fact that much has already been said at the September meeting of the U.S. central bank. The main message expressed by Yellen is that the Fed will not wait for inflation to reach its target level before it further tightens the monetary policy: "We will not pause on the issue of monetary policy, even if inflation remains below two percent," stated the head of the Fed

Yellen's expressed position encouraged the dollar bulls. Inflation has always been their "headache", since against the background of other (very good) data, it has raised doubts in the ranks of traders and regulator members about the prospects for raising rates. Yesterday, Yellen somewhat leveled the importance of the consumer price index and other inflation indicators. Of course, the CPI along with non-farm payrolls will remain as key indicators for the market, only now traders will consider a weak inflation growth through the spectrum of the position of the head of the Fed. In other words, if the consumer price index in monthly terms is at least above zero, it will already be perceived by the market as a positive signal.

This factor significantly changed the fundamental picture for the US dollar. The probability of a rate hike in December rose to 80%, and the prospect of a triple increase in 2018 began to look more real. Such conclusions can also be drawn from Yellen's words that the "too smooth" process of tightening monetary policy can negatively affect the country's economy. Such a "hawkish" position of the head of the Fed gave momentum to the dollar, which at the moment is becoming more expensive for the whole basket of currencies. Greenback is getting more expensive, even despite the very uncertain position of Neil Kashkari, as well as the weak comments of William Dudley and Charles Evans.

It is also worth noting that soon the US currency can get another powerful trump card for its growth. The fact is that today US President Donald Trump plans to present an updated proposal of the tax reform. It should be noted that a few weeks ago Trump met with Democratic Congressmen, whom he particularly needs to agree to support this bill.

However, neither the officials of the White House nor the representatives of the opposition disclosed any details. Evidently, the reform promised by Trump was a peculiar subject of political bargaining, so it's too early to make final conclusions. Nevertheless, today in Indianapolis, Trump will present his updated proposal of the reform, the main premise of which can support the dollar. According to Reuters, the corporate tax rate will be reduced to 20% from the current 35%. For individuals, several tax thresholds will be set at 35%, 25% and 12%. Currently in the United States, there are seven tax brackets for individuals, and all of them exceed 40%.

The tax reform is one of Trump's election promises, as well as the repeal of the Obamacare healthcare program. The goals declared by the U.S. President can be "advanced" to support the US currency. According to his calculations, the reform, if implemented, will not only simplify the country's tax system, but also create additional jobs. The growth in the number of employed and an increase in the average wage level will "disperse" inflation, after which the Fed can accelerate the pace of rate hikes. The reality of such an optimistic conclusion can be questioned, but the market views the start of a tax reform precisely under such a positive light.

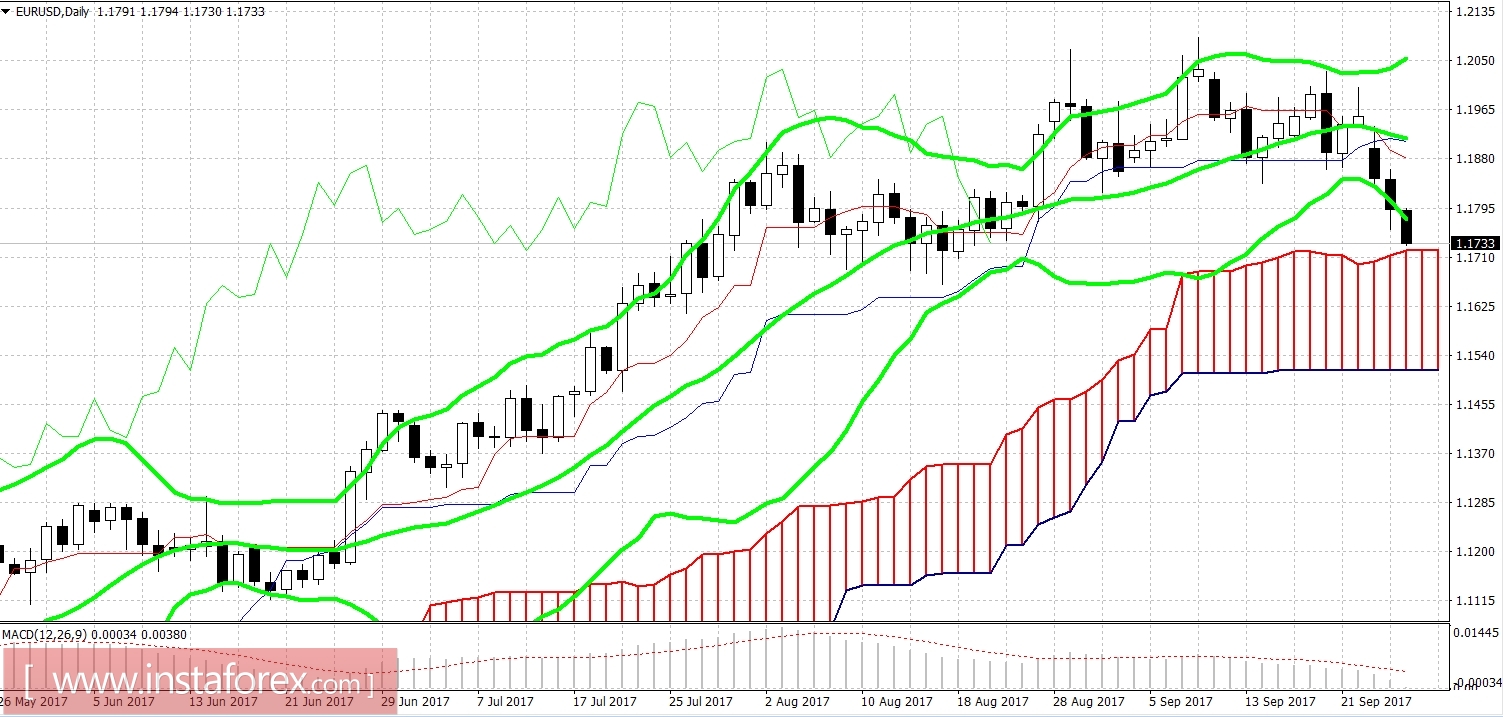

Thus, the correction of the euro/dollar pair may take a more ambitious form. Janet Yellen's "hawkish" position, the prospect of fiscal stimulation, the cautious (and indistinct) ECB policy and the temporary political calm around North Korea: all these factors strengthen the US dollar, and not only paired with the euro.