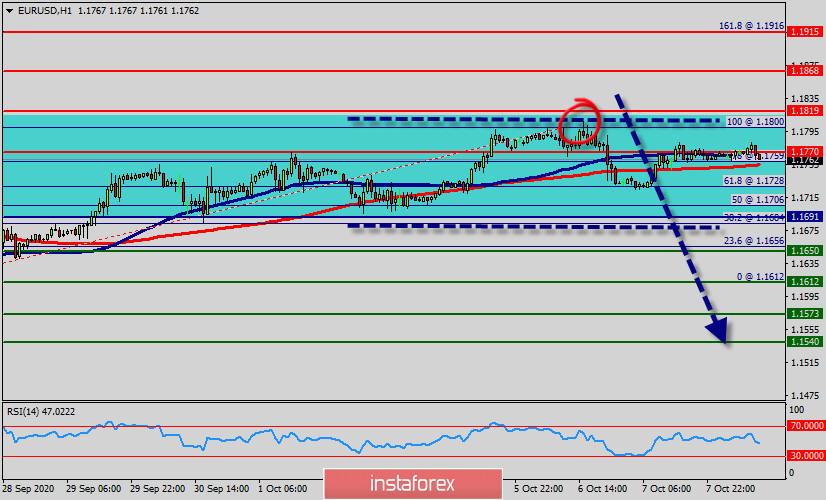

The EUR/USD pair continues to move downwards from the level of 1.1819. Yesterday, the pair dropped from the level of 1.1800 (this level of 0.9965 coincides with major resistance) to the bottom around 1.1759.

Today, the first resistance level is seen at 1.1819 followed by 1.1868, while daily support 1 is found at 1.1691 (the weekly pivot point).

Also, the level of 1.1691 represents a weekly pivot point for that it is acting as major resistance/support this week.

Amid the previous events, the pair is still in a downtrend, because the EUR/USD pair is trading in a bearish trend from the new resistance line of 1.1819 towards the first support level at 1.1691 in order to test it.

If the pair succeeds to pass through the level of 1.1691, the market will indicate a bearish opportunity below the level of 1.1691.

Besides, the weekly support 1 is seen at the level of 1.1691. However, traders should watch for any sign of a bearish rejection that occurs around 1.1650. The level of 1.1650 coincides with 23.6% of Fibonacci, which is expected to act as a major support today. Since the trend is below the double topl, the market is still in a downtrend.

On the other hand, if a breakout happens at the resistance level of 1.1820, then this scenario may be invalidated.