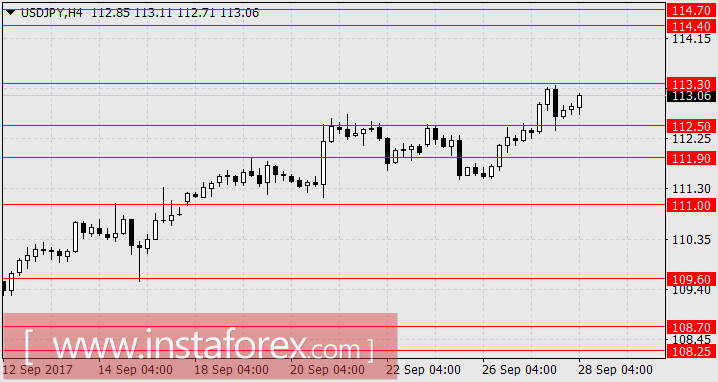

EUR / USD, GBP / USD

According to yesterday's results, the euro fell by 47 points and the British pound by 72 points. According to President Donald Trump, the corporate tax rate will decrease from 35 to 20 percent, depending on the administrative structure of the organization in which the tax will be 25 percent. The six-step tax scale of 10-39.6 percent is replaced by a three-stage tax of 12-35 percent. A number of insignificant privileges for low-income families are envisaged. In general, the project is schematic and the details are not described, which is the same as for half a year. The market's reaction was low-key.

The performance of economic indicators came out mixed. The unfinished sales in the US secondary real estate market fell by 2.6% in August against expectations of -0.5%, but the volume of durable goods orders increased by 1.7% against the forecast of 1.0%. The base indicator of orders increased by 0.2% as expected. James Bullard, the Fed spokesman, expects a gradual acceleration of the economy in the fourth quarter and noted for a weak confidence for employment and inflation. The investors' mood for December continuously increases with the current probability of 78.9%.

Today, investors are waiting for the final estimate of US GDP for the 2nd quarter, the forecast is 3.0% -3.1% against 3.0% in the previous estimate. The volume of corporate profits for the same period is expected to grow by 0.9% against 0.8% in the 1st quarter. The trade balance of tangible goods for August is expected to increase from -65.1 billion to -65.0 billion dollars. The volume of warehouse stocks for August is expected to increase by 0.5%. The number of applications for unemployment benefits may increase from 259 thousand to 269 thousand.

In the euro area, the expectations are also optimistic.The Germany GfK Consumer Climate for October is projected at 11.0 versus 10.9 in September, while retail sales in Spain for August could show an increase to 2.4% YoY from 1.1% YoY previously.

As of this writing, we are expecting that the euro will decline to 1.1680 and the pound to 1.3320. On Friday, the growth of the European CPI is predicted to rise from 1.5% to 1.6%, the UK balance of payments for the 2nd quarter might grow and personal expenses of consumers in the USA (only 0.1% in August) had slightly increased. There may be an upward correction when the first profit is fixed on the emerging new bearish trend for the medium-term.

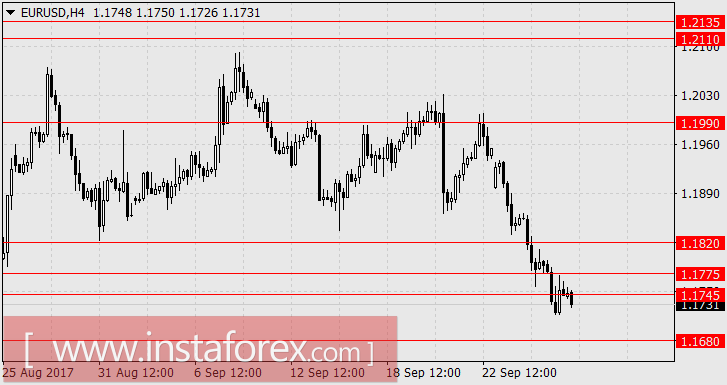

USD / JPY

The Japanese yen continues to rise against the backdrop of the overall dollar strengthening. Optimism is very high, as the previous three-day decline of the Japanese stock index Nikkei 225 growth, the Yen had continued its trend. Today, the situation has become even more favorable, as the Nikkei 225 shows an increase of 0.45%. Even more, optimism is observed in the debt market of Japan, as the yields on government bonds are growing all over the market. Hence, the 5-day securities for three days, yield rose from -0.115% to -0.067% and the 8-year bonds (0.015%) returned to the positive zone.

In the medium term, not everything is growing. In pursuit of a new political trend, Prime Minister Shinzo Abe dismissed the lower house of parliament and appointed re-elections on October 22. Before the end of the current assembly, 14 months ahead of schedule, Abe decided to take advantage of the situation since the arguments within the ruling Liberal Democratic Party did not reach the critical limit. While the opposition is preparing for the elections next year, especially the new party "Party of Hope", did not have time to dial force.

Tomorrow, Japan will release an important data and the outlook seems optimistic. The consumer price index in August is expected to increase from 0.4% YoY to 0.7% YoY, while the base CPI is expected to grow from 0.5% YoY to 0.7% YoY. Industrial production in August is projected to increase by 1.9%, retail sales at an annualized rate are expected to increase from 1.8% to 2.6% YoY. Household expenditures may increase from -0.2% YoY to 1.0% YoY.

We are expecting for the yen in the range of 114.40 / 70.