Yeah, I don't think anything will change in the next decade at least and as Jordan said, the market has very much grown accustomed to the distortion in Swiss money supply conditions since the 2008-09 crisis. Here's a look at the M2 base:

Further Development

Analyzing the current trading chart of Gold, I found-that there potential for the C leg still to develop to the upside.

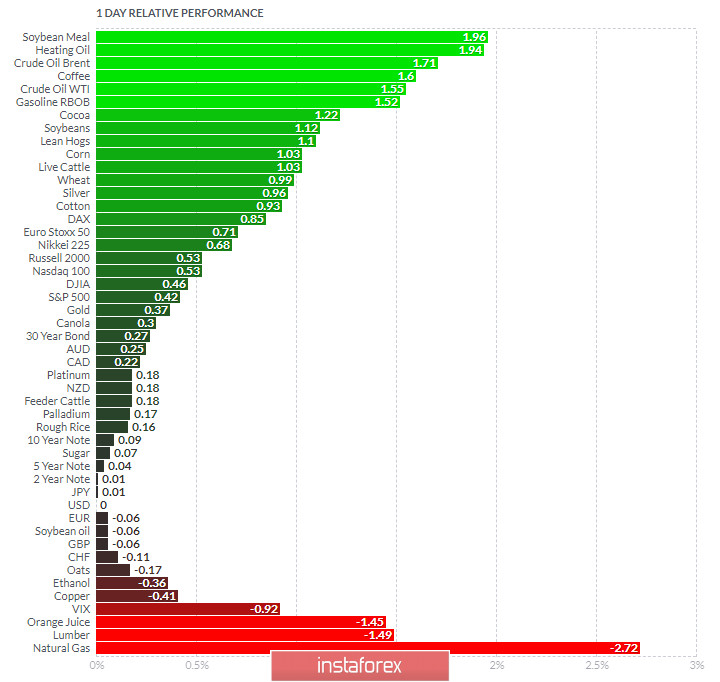

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Heating Oil and Crude Oil and on the bottom Natural Gas and Lumber.

Gold is positive so far today on the relative strength list, which is good sign that buyers are in control.

Key Levels:

Resistance: $1,898 and $1,906

Support level: $1,888