The cross-currency pound/yen pair has increased by 800 points over the past two weeks, reaching a strong resistance level of 150.80 (the upper line of the Bollinger Bands indicator on the daily chart). The further development of events depends on three factors: first,the fate of Brexit, secondly - the position of the Bank of England, and third, the dynamics of Japanese inflation.

Today's speech by Mark Carney and Theresa May was rather solemnly

formal. But in general, all the accompanying data suggest that the Bank of England is ready to raise rates on one of the two remaining meetings this year (in November or December). Such intentions were confirmed also by officials of the British regulator - Gertjan Vlieghe and Andy Haldane. In particular, Vlieghe, who has long called for the the retention of a soft monetary policy, changed his mind to the opposite last week, saying that consumer spending was growing. In turn, the chief economist of the Bank of England Haldane made a more obscure statement today : its meaning boiled down to the fact that a rate hike is more likely positive news for the country's economy than other way around. In general, his speech touched on the economic prospects of Britain in the context of tightening monetary policy.

One more fact indirectly shows the BOE's willingness to lift the rate. Today, the recommendations of the Bank of England to the commercial banks of the country were published. The central bank required them to increase their capital by an additional 10 billion pounds to protect themselves from the "high risk of rapid growth in unsecured consumer lending." The regulator previously conducted stress tests for British banks with the following introductory conditions: with the interest rate of 4%, unemployment at 9.5%. The results of stress tests have shown that credit institutions in such a scenario will incur losses of 30 billion pounds. These recommendations of the Bank of England can not be directly related to the planned increase in the rate, but in relation with other factors, this implication creates an overall picture.

In this context, many expected today's speech by Mark Carney and Theresa May, but they did not say anything specific. It should only be noted that the British Prime Minister did not criticize the Bank of England for its soft policy, as it has done many times before. Firstly, the circumstance did not quite allow this (the anniversary of the Central Bank), and secondly, such criticism would not be appropriate in the context of the actually announced rate increase. Mark Carney also did not say anything clear - as Reuters reports, the head of the English regulator warned that the Bank of England will not be able to fully stop the possible economic blow due to the country's withdrawal from the EU, but at the same time it can affect how the hit will affect the entirety of Great Britain. This phrase is rather blurred and unaddressed, so the pound practically ignored this speech.

But in general, the British currency is in an optimistic background. The initial signal about the planned rate increase is confirmed by indirect factors, which positively affects the currency. And if paired with a strengthening dollar, the pound looks somewhat shaky (especially after the upward adjustment of US GDP), then, in a pair with the yen, the situation is completely different.

The Bank of Japan, at its last meeting, did not begin to change anything in its policy, maintaining loyalty to the wait-and-see attitude. Today at a conference in Tokyo Haruhiko Kuroda stressed once again that prices in the country are growing at an extremely slow pace. He also said that further easing of monetary policy will not cause "excessive financial activity". This language should not be regarded as an announcement of any actions by the regulator, but in general Kuroda's rhetoric was clearly "dovish".

Tomorrow the key indicator of Japanese inflation - the consumer price index, will be published. Since April this indicator has been steadily rising at the level of 0.4%. The indicator for August may defy this "tradition". According to experts, the indicator will increase to 0.7%. It is likely that such a result provokes a downward impulse over the pound/yen cross-currency pair. Correction rollback will increase the number of short positions, however, in my opinion, the pair's sales in such conditions look risky (unless you are a scalper). The overall advantage will still be on the pound side, so in the medium term long positions are preferable.

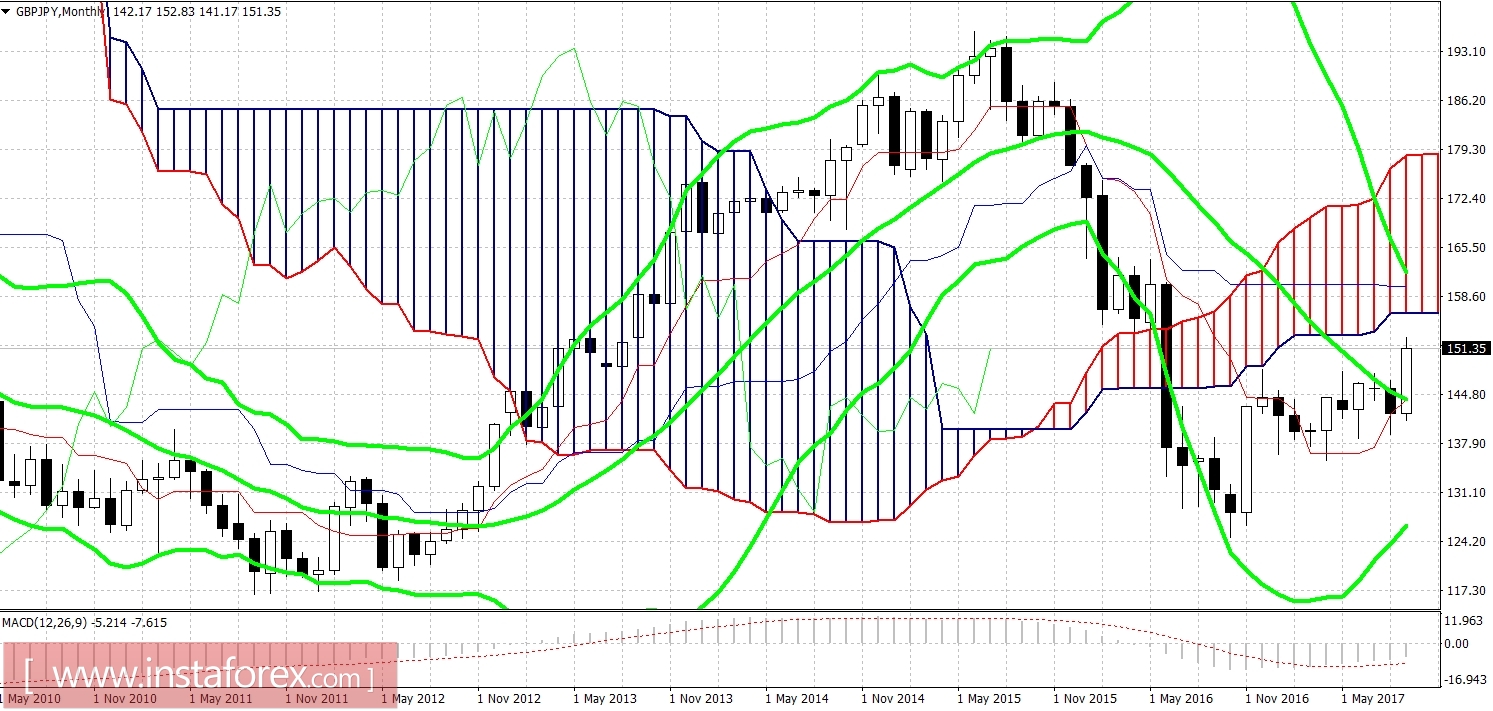

Thus, any more or less large-scale corrective rollback can be used as an excuse for further purchases. On the daily chart, the pair is testing the top line of the Bollinger Bands indicator, and the Ichimoku indicator Kinko Hyo has generated a bullish "Parade Line" signal. All this testifies to the strength of the upward movement. As a target in the medium term, one can take the mark 156.30 - this is the bottom line of the indicator Ichimoku Kinko Hyo on the monthly timeframe.