The British pound remains under pressure in tandem with the US dollar. Data on the growth in house prices in the UK did not affect the pair GBP/USD, as all the attention of investors, today will be riveted to the speech of the head of the Bank of England, Mark Carney. Also, in the first half of the day, there will be a report on the balance of the current account of the balance of payments, which is expected to decrease by 15.8 billion.

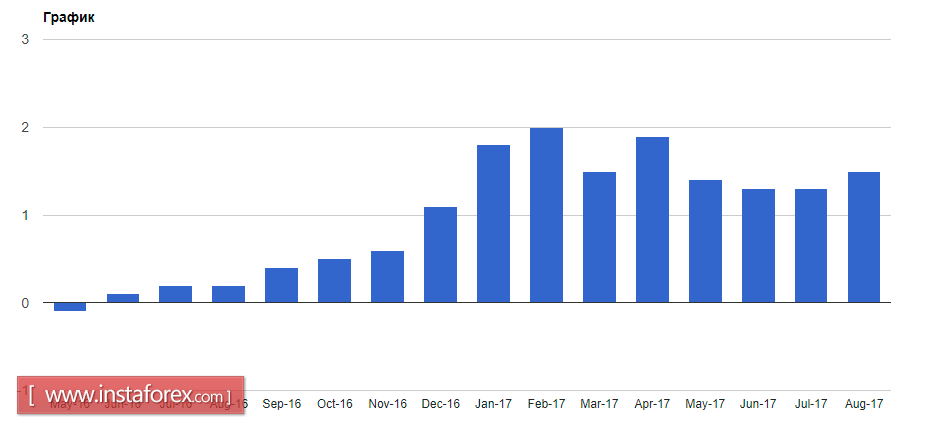

According to Nationwide, in September this year, compared to August, house prices in the UK increased by 0.2% after a decrease of 0.1% in August. Compared to the same period in 2016, prices increased by 2.0%. As noted in the report, the rise in prices led to a high level of employment, as well as low-interest rates on mortgage loans.

As for the technical picture of the GBP/USD, much will depend on the comments of the head of the Bank of England but the chance for a larger pound growth is formed only after the break and consolidation above the important resistance level of 1.3430. Only after that, it will be possible to expect the growth of the British pound with the update of such highs as 1.3500 and 1.3590.

If the comments of the head of the Bank of England seem to the market not entirely suitable, the pressure on the pound may lead to the renewal of such levels as 1.3300 and 1.3230.

Today, it became known that consumer spending in France in August this year fell, which in the future could negatively affect the economic growth of the country.

According to the report of the statistics agency, consumer spending in France fell by 0.3%, compared to the same period in 2016, expenses increased by 1.2%. Economists predicted an increase in August spending by 0.1% and 1.0% compared with August 2016. Data for July were revised downward from 0.7% to 0.6%.

Attention today will be focused on the report on the level of inflation in the euro area.

Given that the European Central Bank cannot achieve a target of 2.0%, today's results could seriously affect the quotes of the European currency if the report differs from the forecast. Inflation is expected to increase to 1.6% in September this year after 1.5% in August.

As for the technical picture of the EUR/USD pair, reaching beyond the upper limit of the channel 1.1800 could lead to a larger upward trend for the euro with the update of 1.1850 and 1.1890 in the short term.

If inflation data is worse than economists' forecasts, and ECB President Mario Draghi does not clarify further prospects for changing monetary policy in today's speech, the pressure on the euro may resume. This will lead to a decrease in the area of 1.1750 and a collapse to the lower boundary of 1.1715.