Today, a number of fundamental data on the Japanese economy came out, which indicates a gradual recovery of economic growth and inflation in the country.

The main headache for the Central Bank of Japan is inflation. Today's data on consumer prices in Japan for August this year make it possible to make more optimistic forecasts to reach the target level of 2.0%.

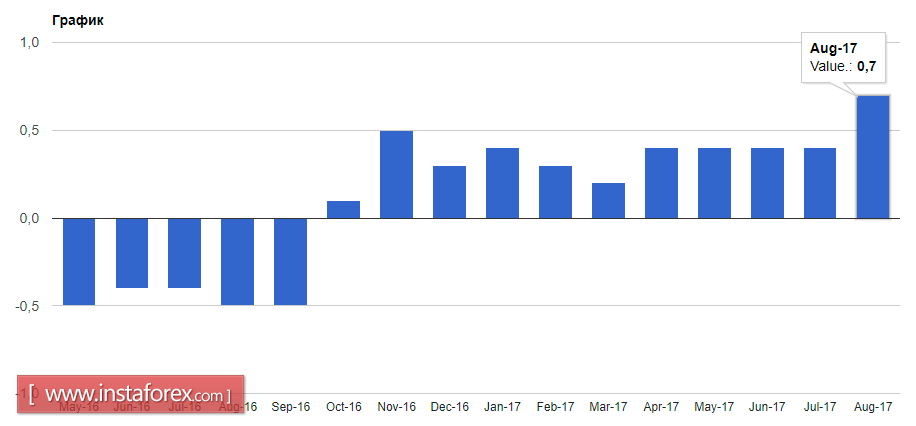

According to the report of the Ministry of Internal Affairs of Japan, the base consumer price index, which does not take into account food prices, in August rose by 0.7% compared to the same period last year, while in July 2017, growth was 0.5%. The data fully coincided with the forecast of economists.

However, despite the growth, the movement to 2.0% level is very slow, which, most likely, will keep the current monetary policy of the Bank of Japan unchanged.

The inflation index, which does not take into account the prices of fresh food and energy, rose by only 0.2% in August after rising 0.1% in July.

In a statement, the Bank of Japan said that it should continue to stimulate demand through additional policy mitigation and consistently support monetary easing.

The Bank of Japan may need to consider additional measures in case of exacerbation of geopolitical risks, and the adoption of new measures will directly depend on the rate at which the movement to the target inflation rate of 2% will occur.

Today, it also became known that household expenses in August of this year increased again. According to the report, expenses increased by 0.6% compared to the same period of the previous year. Economists predicted an increase in expenses by 0.9%. A good increase in spending will have a positive impact on Japan's overall economic growth in the third quarter of this year.

The unemployment rate remained unchanged in August and amounted to 2.8%.

The industrial production of Japan is also in excellent condition. According to the report of the Ministry of Economy, Trade and Industry of Japan, industrial production in August this year increased by 2.1% compared to the previous month. Economists predicted that in August, production will grow by 1.9%.

As for the technical picture of the pair USD/JPY, while the upside potential is limited by the intermediate resistance of 112.80, however, its breakthrough may lead to the return of the trading instrument to the region of monthly highs of 113.15, which could trigger a larger upward movement with the 114.30 update and 115.20 exit.