GBP / JPY

The situation has not changed for the GBP/JPY pair, as conclusions and expectations remain the same. The exit from the interest zone of worked out daily goals (targets for Chikou breakdown and breakdown of the cloud 149.93 - 150.83 - 152.05) will allow considering the development options of the situation. The transition of the day Tenkan (151.28) towards the bears' side gives the current short-term advantage to the players for a decline.

Yesterday, the situation developed in a narrow range between the support region of 150.83 and the resistance of 151.28. Hence, the relevance of the outlined prospects in the previous review kept unchanged. The resistance for today maintained its positions at 151.28 - 151.70 - 152.05, and the support levels can be seen at 150.83 - 149.93 - 149.

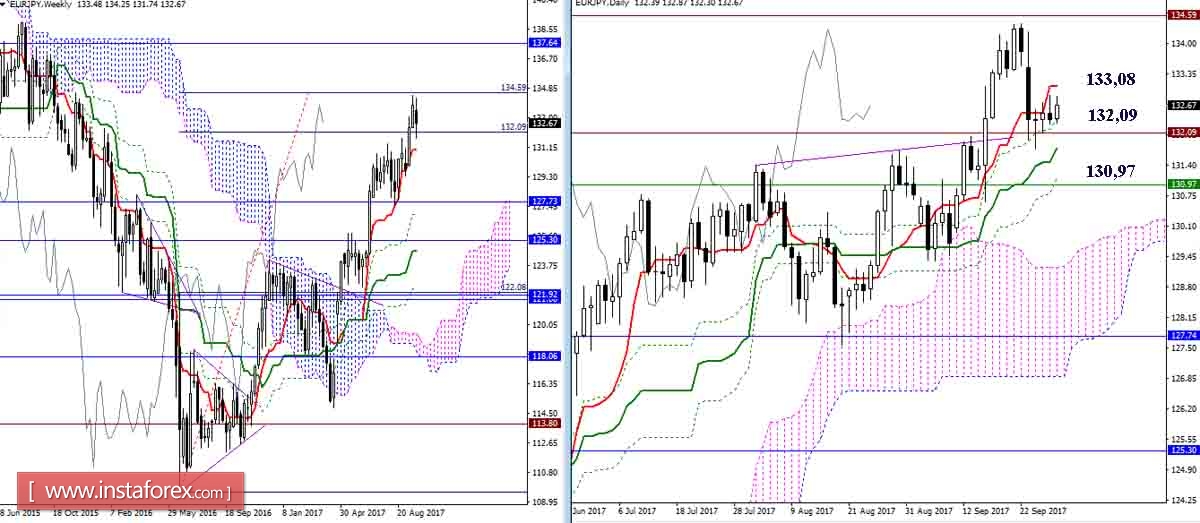

EUR / JPY

Nothing had changed yesterday for the EUR/JPY pair, as expectations and conclusions remain the same. Bears are on the side of the short-term daytime advantage (133.08) and require liquidation of the day cross. The breakdown of the daytime gold cross currently coincides with the outlook for the weekly Tenkan (130.98).

The resistance level at 133.08, consolidate with the record levels of the lower half and the daytime Tenkan, which was able to preserve its significance for this day. Pulling out from the H4 cloud into the bearish zone and overcoming the area 131.76 - 132.09, will open the way for reaching the target at the H4 cloud breakdown, strengthened today by the weekly Tenkan (130.98).

Indicator parameters:

all time intervals 9 - 26 - 52

Color of indicator lines:

Tenkan (short-term trend) - red,

Kijun (medium-term trend) - green,

Fibo Kijun is a green dotted line,

Chikou is gray,

clouds: Senkou Span B (SSB, long-term trend) - blue,

Senkou Span A (SSA) - pink.

The color of the additional lines:

Support and resistance MN - blue, W1 - green, D1 - red, H4 - pink, H1 - gray,

horizontal levels (not Ichimoku) - brown,

trend lines - purple.