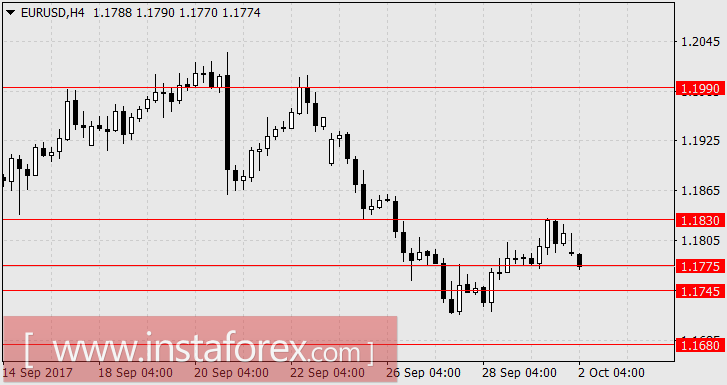

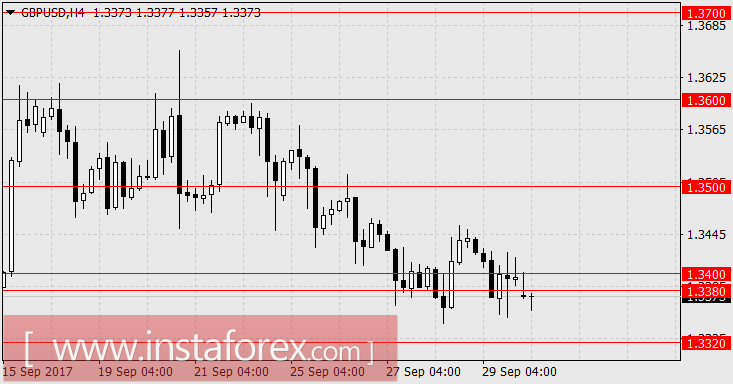

EUR / USD, GBP / USD

The main event last Friday could be the press conference of President Trump about meeting with several candidates for the post chairman of the Federal Reserve. One of them is Kevin Warsh, a former employee of Morgan Stanley and a Board of Governors members of the Federal Reserve from 2006 to 2011, he is known to be a typical "hawk". Based on the information received, the dollar strengthened slightly. Even if Warsh is not appointed for the chairmanship of the Central Bank, any move can be used by the White House to put pressure on J.Yellen.

The British pound came under pressure due to the released weak data on GDP. The final estimate for the second quarter remained unchanged at 0.3%, but the annual estimate was lowered from 1.7% to 1.5% YoY, which was the smallest growth in the last 4 years. Ironically, the speaker of the Bank of England, Mark Carney, who spoke on the same day, said that the Central Bank could raise rates "relatively soon" if the economic indicators continued to show balanced growth. Also, a number of European politicians including Juncker and Grybauskaite reported a slow pace of Brexit talks. The UK balance of payments has also deteriorated noticeably. The revised estimate for the first quarter was -22.3 billion pounds against -16.9 billion earlier, and the current estimate for the 2nd quarter deepened the dip to -23.2 billion pounds. The volume of consumer lending in August fell from 1.166 billion pounds to 1.583 billion, while the number of approved mortgage loans decreased from 68.45 thousand to 66.58 thousand, although the total volume of mortgage loans increased from 3.60 billion pounds to 4.04 billion pounds.

In Germany, August retail sales contracted by 0.4% against expectations of growth of 0.5%. In France, consumer spending fell by 0.3% against the forecast of + 0.2%. The basic CPI of the eurozone fell from 1.2% YoY to 1.1% YoY, while the total CPI remained at 1.5% YoY as the growth was expected to reach 1.6% YoY.

In the US, the situation was more optimistic. The business activity index in the manufacturing sector of Chicago increased in September from 58.9 to 65.2, personal income of consumers in August increased by the expected 0.2%, personal expenses added 0.1%.

Well, a new week and a new month begin with a tremendous event as the Catalonia independence referendum took place on Sunday. In Spain, there are 90% of participants who voted for independence. On the election day, there were massive clashes with the police and more than 850 people were taken to the hospital. Moreover, Madrid does not recognize the referendum. It is suggested that the referendum is organized with the participation of the United States in order to destabilize the region and eventually Catalonia will not leave Spain, but anyway, the current situation helps strengthen the dollar.

Today, the final estimates of Manufacturing PMI for September among the European countries and the eurozone as a whole will be published. Forecasts were generally unchanged, particularly in the euro area which is 58.2. The unemployment rate in the euro area is expected to decrease from 9.1% to 9.0%. According to the UK, Manufacturing PMI may fall from 56.9 to 56.3.

According to the American data, investors' attention may focus on the construction costs for August with a forecast of 0.4%. The ISM Manufacturing PMI for September showed a forecast of 57.9 against 58.8 in August.We are expecting for the euro at 1.1680 and the pound sterling at 1.3320, the decline is insignificant. Tomorrow, the minutes will be released from the last meeting of the Bank of England.

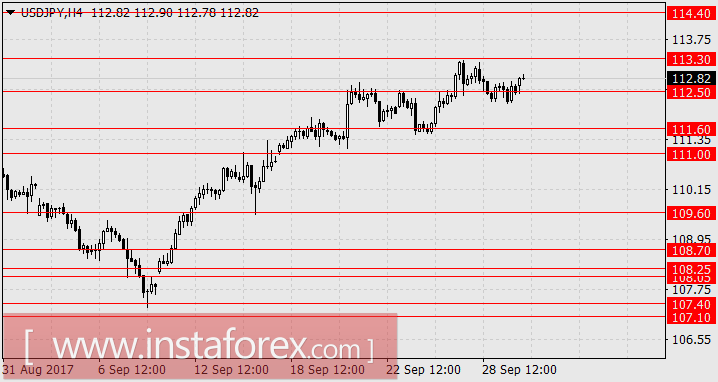

USD / JPY

The yen rebounded both on the overall strengthening of the dollar last Friday and for today (Monday), along with the increasing risk appetite for the stock markets. The American S & P500 added 0.37%, in the Asian session the Japanese Nikkei 225 is growing by 0.14%. Today, positive indicators for Tankan sentiment indices for the third quarter came out. The mood of large manufacturers (Tankan Manufacturing Index) increased from 17 to 22, with the expectation of 18. The final grade of Manufacturing PMI for September was raised from 52.6 to 52.9. Quarterly Tankan Non-Manufacturing Index remained unchanged at 23 points. The sentiment index of Tankan small producers increased from 7 to 10, the mood of small non-manufacturing companies increased from 7 to 8. The Japanese media already uses the published data as an indicator for the success of the incumbent prime minister prior the parliamentary elections on October 22.

Tomorrow will be issued the consumer confidence indicators for September and the data on the monetary base for September. The outlook for both indicators is good; Consumer Confidence could grow from 43.3 to 43.5, the Monetary Base is expected to increase by 16.3% YoY to 17.2% YoY. On Friday, there are also positive expectations on wages and outrunning economic indicators, which can mitigate the negative impact of the expected weak US labor data in connection with hurricanes. We expect the yen to rise to 114.40.