The US dollar again began to be in demand and strengthened against a number of world currencies at the end of Friday's trading session last week, as well as at the beginning of today's Asian session. Statements made by representatives of the Fed last week, as well as good fundamental data, continue to provide support, making investors more optimistic about the prospects for raising rates and lowering taxes in the US.

On Friday evening, FRS representative Harker said that things are going well in the US, and the situation in the labor market is really favorable. In his opinion, it is advisable to pause the cycle of raising rates for federal funds of the Fed, but Harker still expects a rate hike in December this year, as well as three rate hikes in the next year.

Data on business activity also led to the growth of the US dollar. According to the report, the index of supply managers in Chicago for the month of September this year rose to 65.2 points against 58.9 points in August.

Economists had expected the index to be at 58.5 points.

A statement by US President Donald Trump seriously affected the quotes of the US dollar, which led to growth. Trump said he wants to decide on who will take over as chairman of the Fed before the end of this year. Whether the position of the current chairman of the Fed, Janet Yellen, will shake, is not entirely clear, but the fact that the Fed will be more cautious with the statements is now clear. Let me remind you that as early as this year, representatives of the US Federal Reserve System stated that all decisions of the committee would be made independently, so as to exclude political influence as much as possible.

As for the technical picture of the EURUSD pair, it is clear that the pressure on the euro will continue in the near future. Returning to the level of 1.1780 is a very strong signal to increase the short positions in the instrument in order to update the lower boundary of the channel in the area of 1.1715-1.1720, where, it is quite possible, to have a temporary stop.

The growing tensions between the US and North Korea will continue to support the US dollar. So, the breakthrough of the range of 1.1715-1.1720 could lead to a bigger collapse of the EUR/USD pair already with the update of levels such as 1.1660 and 1.1560 in the short term.

The Japanese yen continues to remain under pressure in tandem with the US dollar, even despite good data on the growth of confidence of Japanese companies.

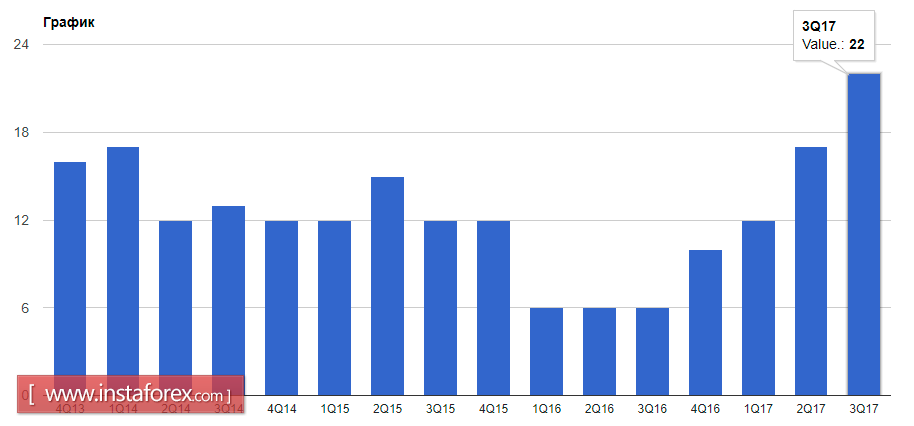

According to the report, the confidence of companies reached a 10-year high. It happened as a result of the country's continued economic growth. Thus, the index of sentiments of major producers in the period from July to September this year rose to a level of 22 points against 17 points. Large producers expect a profit growth of 4.7% in the current financial year. Three months ago, this figure was at the level of 3.3%.