The mood of the market is gradually shifting towards the realization that the Fed will not only continue the cycle of raising interest rates and reducing the balance sheet, they will also possibly have a new head. The new Fed leader will play a significant role in the future actions of the bank.

D. Trump announced that he wants to decide on a new candidate for the head of the Federal Reserve after the resignation of J. Yellen. Her contract ends in February. The President also announced his intention, together with Finance Minister S. Mnuchin, to meet with a new candidate for the position of head, Kevin Warsh, who was previously the head of the federal bank and had a "hard" view of the monetary policy for the regulator.

"I held four meetings on the issue of the head of the Fed and will take a decision within the next two or three weeks," he told reporters. Yellen's term expires in February. (Reuters)

Evaluating this state of affairs, it can be assumed that if K. Warsh is proposed to the position of the head of the Central Bank and is approved, this will be a significant event because the head of the Federal Reserve will be a person deprived of a "soft" view on monetary policy.

An additional positive for the dollar, in addition to the ones mentioned above, will be the adoption of a new tax code in the US, proposed by D. Trump during the pre-election program. If it is adopted, it will be the strongest stimulating factor for demand for the dollar. Liberal tax reform will stimulate investment activity within the United States, which will attract capital inflow of American investors, as well as foreign capital.

On Monday, investors' attention was drawn to the publication of these activity indexes in Europe and the United States. The indicator for European countries demonstrated multi directional dynamics. It grew in France but was under pressure in Italy and the eurozone. Meanwhile in Germany, it remained at the same level.

Observing the situation on the foreign exchange market, we can assume that the US dollar will receive support on any positive news from the US, which will stimulate the growth of the dollar.

Forecast of the day:

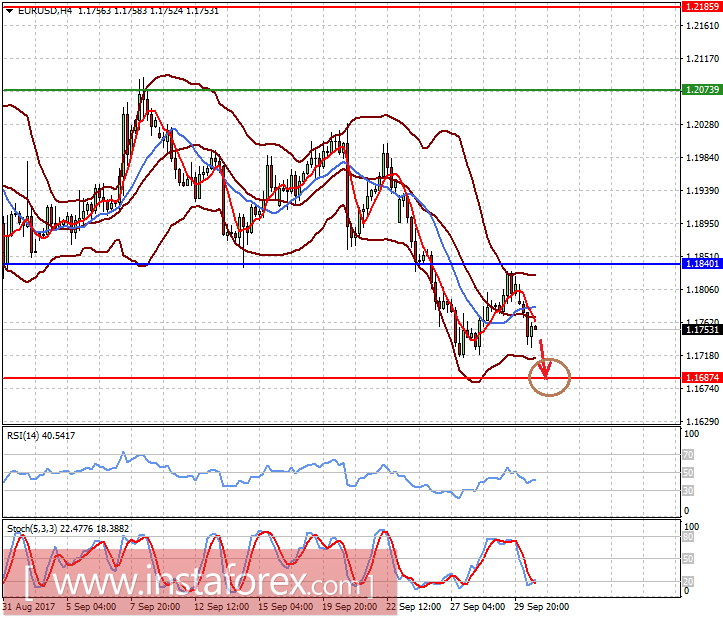

The EURUSD pair is trading below the important key level of 1.1800 in a wave of events that are booming in Catalonia. Negative news about the desire of the Catalans to withdraw from the Spanish Kingdom will put pressure on the euro on the eve of the ECB meeting on monetary policy. On this wave, the pair may fall to 1.1685 after overcoming the 1.1715 mark.

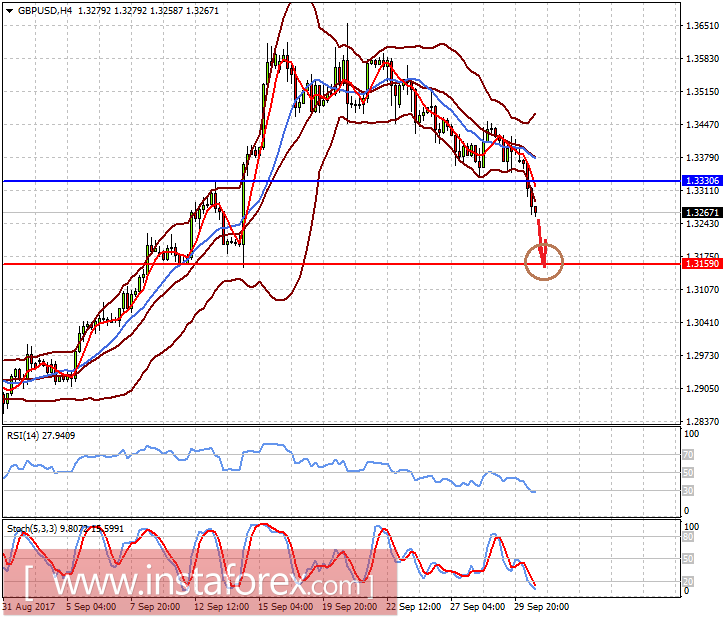

The GBPUSD pair broke through a strong support level at 1.33.30 amid the publication of weak data on manufacturing activity in the UK. This situation may lead the pair to the level of 1.3160.