The referendum in Spanish Catalonia, the next provocation of relations between the DPRK and the United States and the choice of candidacy for the head of the Federal Reserve - all these fundamental factors are frantically discussed by the market.

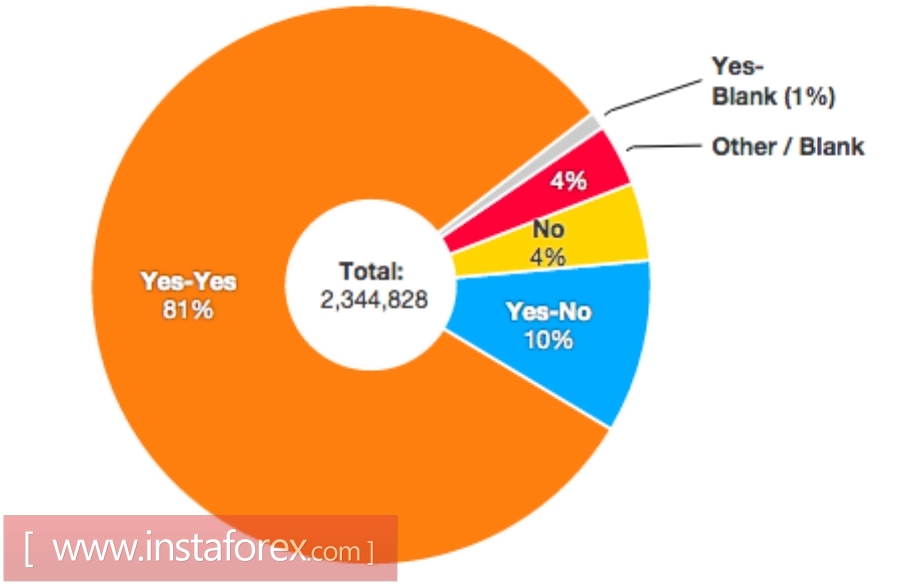

The most urgent problem for the European currency is a surge of separatism in the third most important economic country in the EU. The results of the referendum were predictable - more than 90% of Catalans voted for the independence of their region. And although such results were really predictable (it's not for nothing that Madrid forbade this referendum), the prospects for future events look vague.

There are several main scenarios that can be realized in the coming days and months. The first of these involves a political positioning, in which the Spanish authorities do not recognize the result of the held referendum, and the Catalans will not declare its independence. The situation will remain in limbo for an indefinite period. The second scenario is more harsh: the officials of Catalonia will try to bring the matter to its logical conclusion, while Madrid will keep the region by force - which can lead to the introduction of troops. Bloody clashes with the police showed that Madrid is very serious and, if necessary, will resort to the most radical options. The third scenario assumes a "depletion" policy. According to this, the Catalan Parliament will still recognize its independence, but the Spanish authorities will not use force, in the expectation that the EU countries and the majority of the states of the world do not recognize an independent Catalonia.

Which of the above scenarios will unfold- it is difficult to say. In the coming days, the government of Catalonia will send the results of the referendum to the parliament of the region, which will then make a political decision. In terms of the foreign exchange market, all three scenarios are negative. Catalonia accounts for one fifth of the GDP of the whole of Spain, and most Spanish offices of multinational corporations are located in Barcelona. Catalans themselves have long expressed dissatisfaction with the system of budget transfers, when the region gives to the general budget more than it receives.

Naturally, the declared independence concerns not only political, but also economic processes in the country, therefore the European market will again live in conditions of uncertainty. Many experts already say that the Catalan referendum will "turn around" with a decrease in investment attractiveness, rising unemployment and a fall in Spain's GDP. Obviously, all this will affect the pan-European indicators, which in turn will influence the ECB's determination to curtail the QE program (this is not about a hypothetical variant of raising the rate). Of course, it now depends on the negotiation process between Madrid and Barcelona - but if the most severe scenario is implemented or the uncertainty option is chosen, the euro will continue to remain under considerable pressure, which could intensify if the Catalan problem affects the EU inflation, unemployment and GDP indicators.

Simultaneously with the weakening of the European currency, the US dollar continues to gain momentum. And although the dollar strengthens the positions "in advance", against the backdrop of expectations of events that have not yet happened, the market uses the principle "buy on the rumor, sell on facts".

First, it concerns the prospect of tightening the monetary policy of the Fed. The 80% probability of a rate hike in December is already taken into account in prices, so the market now shied away from the perceived scenario of a triple increase in 2018. Ignoring the modest data on personal consumption in the US (release was on Friday) suggests that traders will expect the Fed to take decisive action even against the backdrop of weakly growing inflation. Such expectations look quite reasonable after the statements of Janet Yellen, who last week announced that the Fed will not "pause" the process of raising rates due to low inflation.

Another event that excites the market is the change in leadership of the US Federal Reserve. Vice-President of the Federal Reserve Stanley Fischer retires in two weeks "for personal reasons," but the powers of the head of US regulator, Janet Yellen, will end in February next year. At the moment, traders are discussing options for candidates, especially since Donald Trump said that he is still pondering on this topic and will take a final decision in two or three weeks.

The nomination of Kevin Warsh caused the special revival of the topic. According to the influential news agency Reuters, now it is he who is the favorite among the other rivals. This is due to the fact is that he was already a member of the board of governors of the Federal Reserve and is known his "hawkish" views. He consistently defended the idea of a tight monetary policy even during the 2008 crisis. According to Reuters sources, Warsh has the best chances to head the Fed. Earlier, the favorite was called the director of the National Economic Council Gary Cohn, so a certain intrigue still persists. Officially, the White House only acknowledged the fact of Trump's consultative meeting with Warsh, but did not disclose any other details.