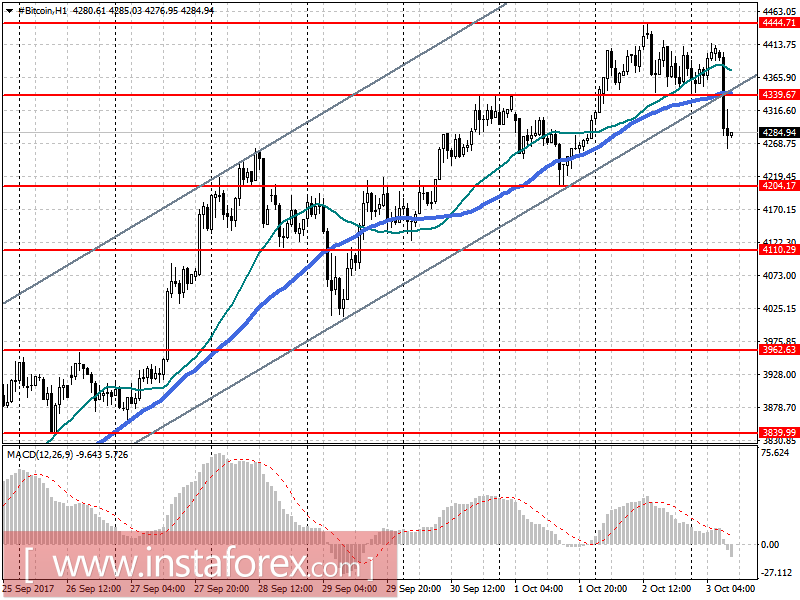

Against the backdrop of calm trading on Monday, bitcoin climbed to important levels of resistance, but it was not possible to stay above the determining level of support for 4340, which led to its breakdown and a break in the uptrend.

Today, the representative of the Federal Reserve Bank of Philadelphia, Patrick Harker, said that bitcoin and a number of other crypto-currencies are unlikely to weaken the influence of the Federal Reserve on the US economy. According to Harker, strict regulation by the SEC will get rid of a number of problems related to crypto-currencies. Let me remind you that many economists are worried that the growth of the crypto-currency will make it more difficult for the Fed to manage inflation, but Harker believes that such a scenario, at least now, is hardly possible.

The good news for crypto traders was the information that the largest bank Goldman Sachs can introduce a trading option that allows you to make transactions with bitcoin and other digital currencies. As noted in the Wall Street Journal, this American bank can become the first representative of Wall Street, which directly introduces trade in crypto-currencies.

The signal to Bitcoin purchases (BTC):

For buyers, yesterday's high was the level of 4340, which was broken today at the beginning of the day. Now I recommend returning to buying bitcoin only after updating to 4204 or to rebound from 4110. There is also a scenario of returning to 4339 in the morning, which can save the upside potential bitcoin with the goal of updating to 4444 and reaching 4556.

The signal to Bitcoin sales (BTC):

The fracture of the lower border of the rising price channel, formed since the end of September, may indicate the completion of the current growth of bitcoin and the formation of a major downward correction. In the event of an unsuccessful return to 4340, sellers can strengthen their positions, which will lead to the update of 4204 and 4110 in the short term, where I recommend fixing profits and looking for long positions.