s report to likely reflect higher unemployment after ONS methodology change

s report to likely reflect higher unemployment after ONS methodology change ONS announced a revision to their methodology in capturing the jobs data

The gist of the announcement is that the last few months i.e. pandemic period had been capturing a sample far less representative of the general UK population, which may have resulted in a lower jobless rate as such.

Back in February around 67 per cent of households in their first interview in the LFS sample were owner occupiers and 32 per cent were renters. But in July this was around 77 per cent and 21 per cent respectively. Such a shift in tenure over this short time period is implausible, so this is evidence that the LFS is now picking up a different - and possibly less representative - sample... For tomorrow's release we will therefore reweight the estimates so that the shares of owner occupiers and renters are the same as before the pandemic hit in March. This should give us a much more representative set of labour market statistics.

So, this will be a heads up to the jobs report for August tomorrow, where the unemployment rate is expected at 4.3% - in case the reading comes quite far off that.

As I discussed in the previous review, the Gold managed to complete the downside correction ABC and I do expect further higher price.

Further Development

Analyzing the current trading chart of Gold on daily time-frame, I found that there is fialed bear flag pattern, which is good indication for further rise.

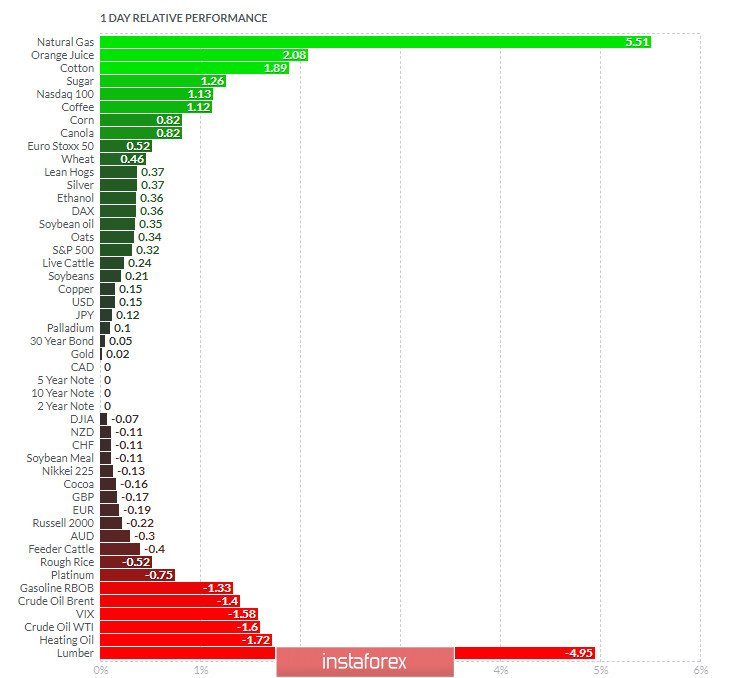

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Natural Gas and Orange Juice today and on the bottom Lumber and Heating Oil

Gold is neutral on the relative strength list today...

Key Levels:

Resistance: $1,970

Support level: $1,917