The euro was falling earlier this week amid political turmoil in Europe. This posed a threat to risky assets after a serious increase for almost 3 quarters this year. The talk about the likely increase in interest rates of the US for the month of December this year also fueled the demand for the US dollar.

It should be noted that the fall of the euro continued after Catalonia overwhelmingly voted for independence from Spain last Sunday. Meanwhile, the government of the country announced the illegality of this referendum. Such results could undermine the political integrity of the euro area.

Despite this, data on producer prices in the euro area provided short-term support for the euro today. This prompted traders and investors to return to the conversation on the curtailment of the bond purchase program from the ECB.

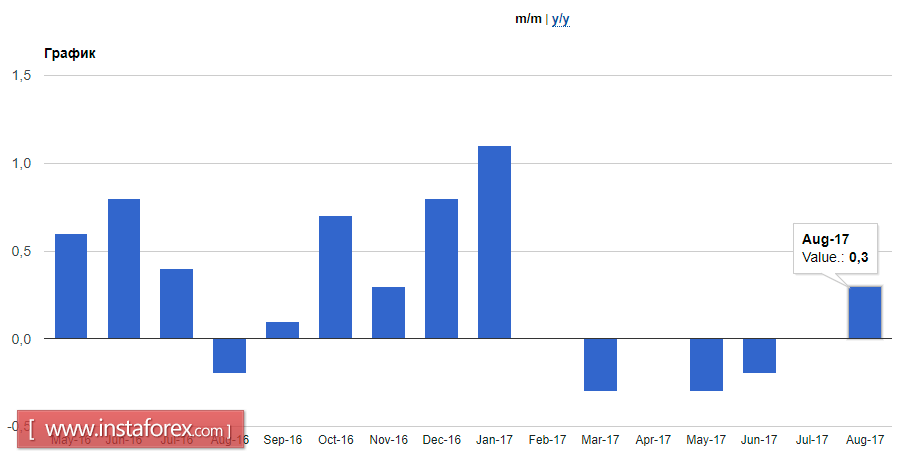

According to the Eurostat report, inflationary pressures in the euro area continue to increase. In August this year, producer prices rose by 0.3% compared to July and by 2.5% compared to the same month of the previous year. Economists had expected growth of 0.1% and 2.3%, respectively.

More recently, ECB President Mario Draghi drew attention to the fact that the bank's management could decide on the fate of the bond purchase program at the October 26th meeting. If this program is completed in December this year, and its volume is 2.3 trillion euros, then a serious shakeup on the financial markets is possible, which will attract new buyers of the euro.

As for the technical picture of the EURUSD pair, its return to the resistance of 1.1760 and stop there indicates a lack of serious support from large buyers of risky assets. Most likely, it is at this level in the short term that bears will try to stop the current upward corrective trend and return to the trading instrument at the end of the day to the area of more acceptable levels at 1.1725.

The British pound declined against the US dollar after data on the UK economy turned out to be worse than economists' forecasts. According to the report of Markit, the index of supply managers for the construction sector of the UK in September this year fell below 50 points, indicating a reduction of activity in the sector. So, the index fell to 48.1 points from 51.1 points in August. Economists predicted that the index will remain above 50 points.