The US dollar opens wide prospects for further global strengthening. This is primarily due to the continuation of the cycle of raising interest rates. In December, an increase in rates is expected with a probability of 81.7%, according to the dynamics of futures on the rates for Federal funds. Last week, such a probability was estimated at 74.1%.

Of course, the expectations of growth rates are maintained for a reason. The main reason is the Fed's confidence that the inflationary pressures that have been suspended in the last few months will intensify, not only in the wake of positive dynamics in the US labor market, but also in the process of reducing the regulator's balance sheet. It should also be noted that because of the forthcoming tax reform, it is most likely that it will become the main reason for the unraveling of inflation due to tax cuts and targeted incentives to selected sectors of economies. This is supposed to be an incentive for an increase in the number of new jobs inside the US, which in turn will lead to rising public spending that will stimulate inflationary pressures.

It is assumed that if the budget deficit is increased by 2-2.5 trillion dollars, it will be a strong incentive to increase consumer inflation above the target level of 2.0% and that it could threaten it with further growth. It is expected that the new tax code will be adopted by Congress in the first quarter of next year. That's why the Fed should not stop and continue the cycle of raising interest rates. There is also an opinion that this state of affairs may force the US Central Bank to raise rates above the planned amount in 2018 and 2019.

Such prospects will provide appreciable support to the dollar. And this will happen not only because of the continued increase in rates and the reduction in the balance of the regulator, but also because of the growing demand for dollars abroad, since the new economic reality, with the adoption of tax reform in the United States, will make investment in the real sector of the US economy attractive. This wave will not only mark the repatriation of American capital into the country, but also the revival of the flow of investment from abroad.

Forecast of the day:

The EURUSD pair is trading above the level of 1.1750, remaining under pressure on the wave of expectation of growth rates in the US, as well as the possible hesitancy of the ECB to stop stimulating the European economy next year. Against the background of these reasons, as well as publication of employment data from ADP, if they exceed the forecast of growth by 125,000, the price may fall to 1.1655.

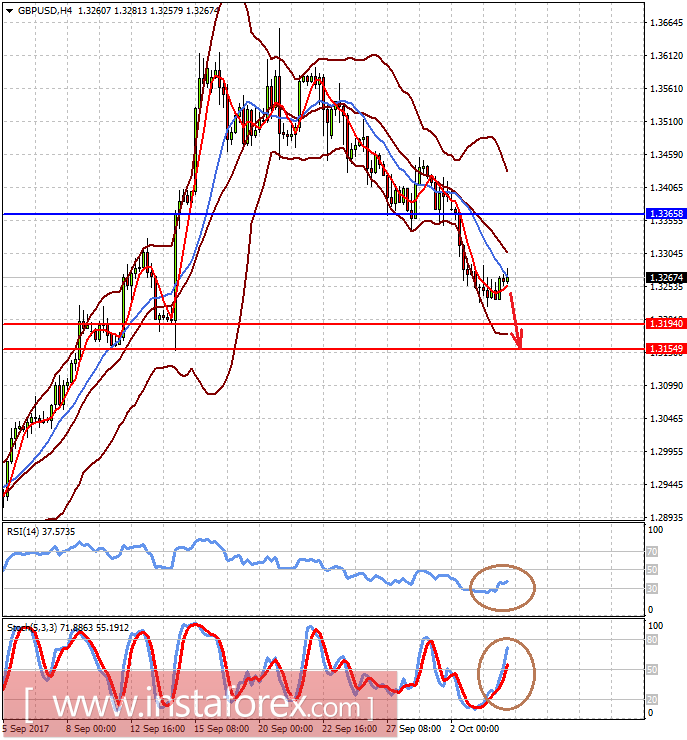

The GBPUSD pair has the potential to continue falling if data from the UK business activity index in the services sector for September will go below the forecast of 53.2 points. This could lead to a drop in prices to 1.3195, and then to 1.3155.