The European currency managed to restore a part of its position yesterday in pairing with the US dollar after the release of good fundamental statistics, as well as against the backdrop of a low volume of trading before the publication of important data on the US labor market, which will come out by the end of this week.

Despite this, the demand for the US dollar in the medium term is quite acceptable. According to the interest rate futures market, the 78% probability that the US Central Bank will raise interest rates in December of this year, against the 44% probability a month ago, is currently taken into account.

Problems in Spain, which are still of a more political nature, also limit the upside potential of the European currency in the short term. It is likely that the good economic growth that has been observed during the last few quarters will gradually slow down against the backdrop of an attempt to the secession of Catalonia, which will negatively affect the rate of the European currency.

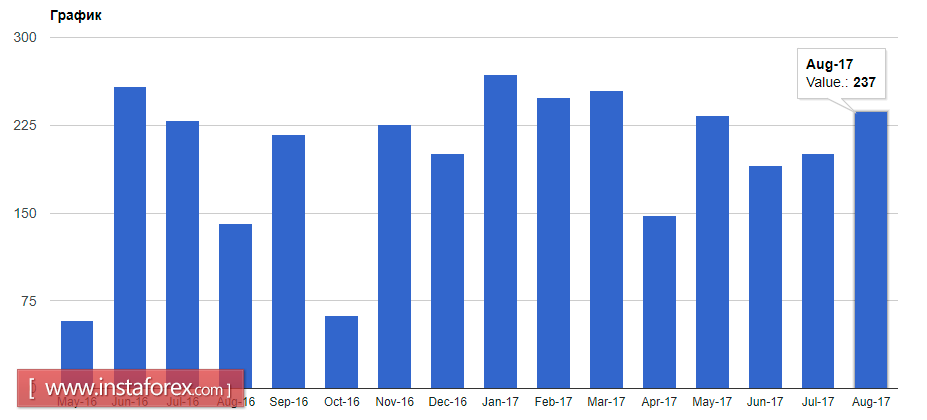

Today, it is important to pay attention to the data on the change in the number of employed from ADP in the US, which may lead to renewed demand for the US dollar. It is expected that the number of employed will increase by 131 thousand in September after an increase of 237 thousand in August this year. A weaker report on job growth may shake the positions of the US dollar, which will lead to the strengthening of a number of other world currencies.

As for the technical picture of the EUR/USD pair, the current impediment for buyers is the intermediate resistance level of 1.1780, the breakthrough of which will lead to the formation of a new upward wave on the risky asset with the purpose of updating the area of 1.1830.

Leaving the trading instrument under the support level of 1.1735 can hit a number of stop orders of euro buyers, which will lead to an immediate decrease to monthly lows in the area of 1.1700.

Also today it is important to pay attention to the speech of representatives of central banks. In the afternoon, ECB President Mario Draghi will make a speech, which may reveal some plans for winding up the bond redemption program at a meeting to be held later this month. Speech of Fed Chairman Janet Yellen will also be important.

Speech on inflation and labor market indicators may provoke an increase in demand for the US dollar, as this will increase the chance for interest rates to increase by the end of this year.

Quotes of oil fell from their monthly highs. This happened after investors started taking seriously the probable increase in the growth of oil production, as well as the rebalancing of world demand and supply in the market. Today, all attention will be focused on the weekly report of the US Energy Information Administration, which will also assess how negative the impact of the hurricane season was.