EUR / USD, GBP / USD

On Wednesday, the euro and the pound increased slightly on the profit fixation of the European sellers and beat expectations on business activity indicators in the services of the euro area and the UK. The final estimate for the Eurozone PMI Services in September was raised to 55.8 against expectations of 55.6. The British PMI services increased from 53.2 to 53.6. However, retail sales in the euro area for August fell by 0.5% against growth expectations of 0.3%. On the positive note, the good news is that the US ADP Non-Farm Employment Change for September in the private sector created 135 thousand jobs against the forecast of 131 thousand.

The figures for August was revised downwards to 228 thousand from 237 thousand previously, due to a decline in investors employment data during the surge of hurricanes, which is not literally relevant. Business activity in the non-manufacturing sector from the Institute for Supply Management (ISM) showed an impressive growth in September from 55.3 to 59.8, and this is one of the best indicators since 2005. The final evaluation for September Services PMI from Markit was also better, showing 55.3 versus 55.1. Mortgage rates from MBI are growing from 4.03% to 4.12% for the third consecutive week, against the background of growth in mortgage applications. This is also a positive aspect of the past storms.

Today, expectations for the United States statistics are also positive. The weekly report of the Ministry of Labor about the applications for unemployment benefits may reduce from 272 thousand to 266 thousand, even after the sharp surge in August from 236K to 298K failed to establish optimism. The trade balance is expected to decline in August from -43.7 billion dollars to -42.7 billion. The increase in factory orders for August is expected at 1.0%.

Overcoming such optimism enable any development, perhaps, only very aggressive minutes of meeting since the last ECB conference at 12:30 PM London time. On the other hand, investors indicated some caution yesterday prior the main Friday event, which is the release of American non-businesses. We expect the indicator to came in better than the forecast.

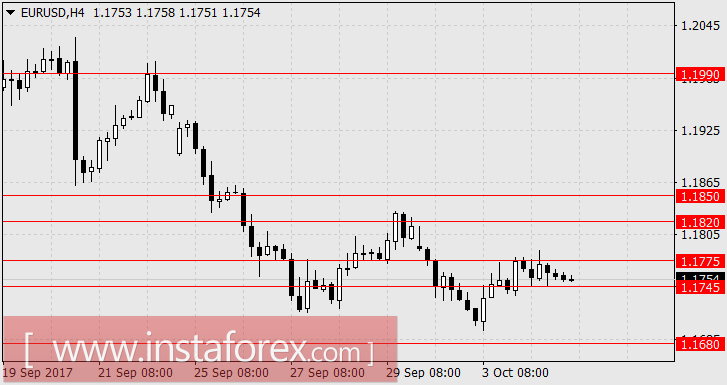

We are expecting for the euro in the current range of 1.1745 / 75 until Friday. The range of the British pound is 1.3250-1.3320.

AUD / USD

AUD / USD

Yesterday, the Australian dollar showed stronger growth than the euro and the British pound, with 28 points. The Australian currency is under the pressure of commodity markets. But today in the Asian session, due to the issued disappointing data on retail sales, the growth yesterday was stalled by a decline. In the August estimate, retail sales fell 0.6% against growth expectations of 0.3%. In the four-month consecutive decline, Retail Sales ranked second as the most negative indicators. The trade balance for August showed an increase from 0.808 billion dollars to 0.989 billion, and the previous figure was revised upward from 0.460 billion dollars. The quality of the balance sheet was good, as exports increased by 1.0%, imports remained at the previous level. But apparently, the market could not grow because of mixed statistics, uncertainty with US labor data on Friday and the continued pressure of commodities. Yesterday, the oil fell by 0.9%, iron ore halted the decline at a price of 62.05 dollars per tonne (the levels of November 2016 and May 2017), non-ferrous metals are traded in different directions. In general, the positive growth of exports creates the prerequisites for positive GDP and, accordingly, for a longer reflection of the RBA over the policy of rates.

Thus, we are expecting the price of the Australian dollar in the range 0.7790-0.7830. In relation to the main scenario, we assume a further decline under the pressure of the US dollar to 0.7750. The further target is 0.7680.