Reuters reports, citing sources familiar with the matter

For some context, there is a OPEC+ JMMC meeting taking place today so the headline pertains to that. I wouldn't doubt that they would leave the door open to extend cuts into next year, but any firm decision will only be made at next month's meeting.

Further Development

Analyzing the current trading chart of Gold, I found that our first target at the price of $1,913 from my Friday's analysis has been reached.

I see potential for the test of the second upside target at the price of $1,930 due to strong upside momentum and fresh money flow to the upside.

My advice is to watch for the pullbacks on the intraday frames and look for long positions with the target at $1,931

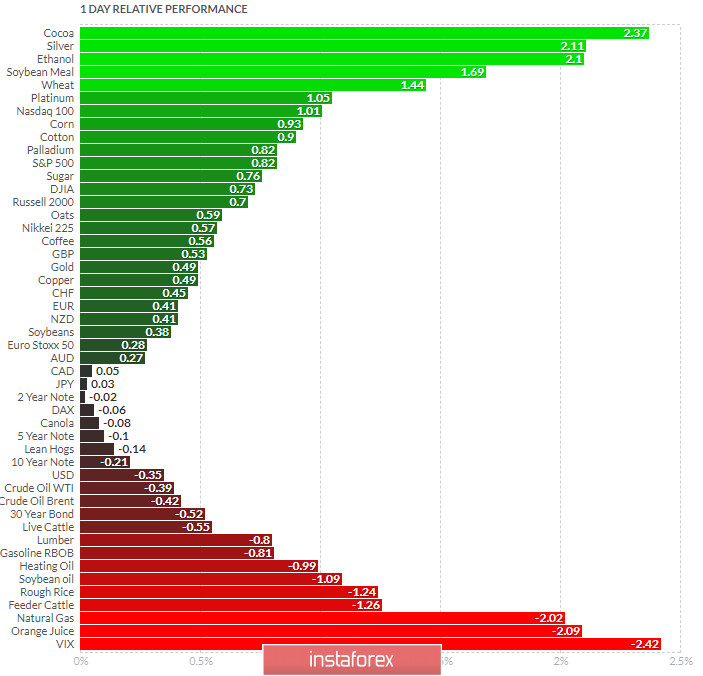

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Cocoa and Silver today and on the bottom VIX and Orange Juice.

EUR is holding well on the relative strength list, which is another confirmation for the upside momentum.

Key Levels:

Resistance: $1,913 and $1,930

Support level: $1,900