Bloomberg reports, citing people familiar with the matter

The report says that the BOJ is likely to consider changing its inflation forecasts at its monetary policy meeting next week, to reflect the short-term impact on prices of the government's travel campaign .

The BOJ is said to probably discuss cutting its inflation forecast for this fiscal year to account for the downward pressure on prices - due to the discounts offered - from the 'Go To' travel campaign - which is currently set to run through to 31 January 2021.

That said, the sources say that the downgrade in the projections will not trigger any additional action by the BOJ with discussions to also look at the upward pressure set to take place when the campaign is no longer in operation.

Further Development

Analyzing the current trading chart of Gold, I found that Gold is in consolidation but still in the mid-long term upside trend.

My advice is to watch for buying opportunities if you see the breakout of the $1,930 with the upside targets at $1,970 and $2,000

Additionally, there is the completion of the ABC major in the background, which is another sign of of the strength.

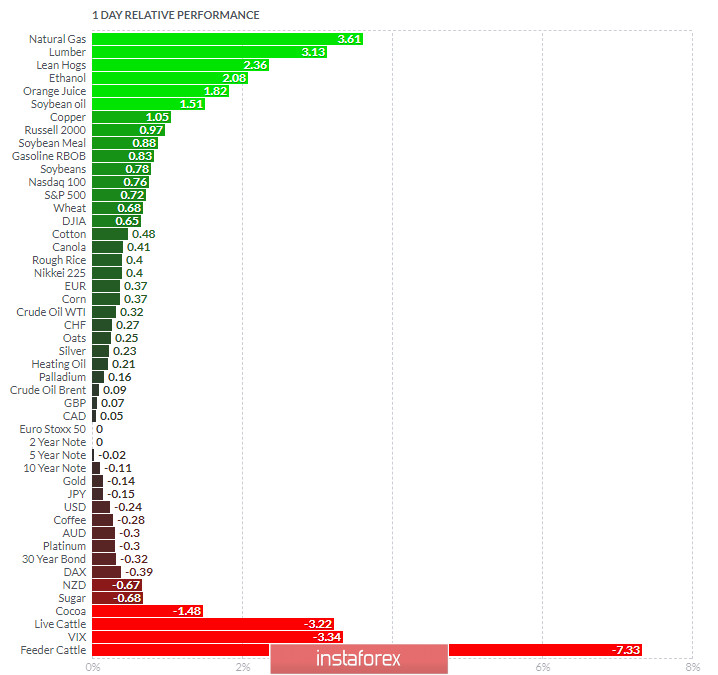

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Natural gas and Lumber today and on the bottom Feeder Cattle and VIX.

Key Levels:

Resistance: $1,930 and $1,970

Support level: $1,990 and $1,856