EUR / USD, GBP / USD

The main event on Thursday was the fall of the New Zealand dollar by 130 points due to the internal political problem in forming the government, since none of the parties received the required majority votes on September 23 elections. Acting Prime Minister Bill English, from the National Party with 46.0%, failed to form a coalition majority with the NZ First party (New Zealand is more important, 7.5%), as he mentioned yesterday. In this case, the authority to form a government will be pass to the party that gained the second place, which is the Labor Party with 35.8%. Apparently, the problem with the decline of the "New Zealand dollar" is not entirely due to the political crisis. Even before the elections, the NZD fell ahead of the Australian dollar and to the single European currency and British sterling pound. Then the focus shifted to the review of "Little kiwi pecks a big euro," which talked about the pressure on the euro through minor currencies. In connection with the fact that the euro failed to break below 1.17 level is mainly because of high speculative volumes in purchases, creating a new attack towards the euro from afar. This attack is needed by the dollar as of this writing. Carles Puigdemont, head of Catalonia, did not submit a response regarding Catalonia's future intentions after the referendum. While Spain's Prime Minister Mariano Rajoy announced the restriction of rights for the Catalan autonomy, effectively depriving the independence status, which will formally be fixed on Saturday. As noted earlier, the situation repeats the Greek scenario as Greece refuse to accept the terms of creditors after the referendum and received even worse conditions for lending. With this, the euro rose to the news.

The British pound had no reason to grow. Retail sales in England for September decreased by 0.8%, versus the expectation of -0.1% only. While in the United States, the number of applications for unemployment benefits is lowered down to 222 thousand against the forecast of 240 thousand. The business activity index in the manufacturing sector of Philadelphia in October, increased by 27.9 instead of the projected decline from 23.8 to 21.9. Late in the evening, the US Senate approved the "Trump budget" for 2018. Clearly, a deficit of $1.5 trillion is planned for 10 years, which means that a large-scale tax reform and active external swap through borrowing was finally given a green light. It also indirectly implies the approval of Janet Yellen in her post for a second term. The dollar began to intensify this morning.

Today, the Euro area balance of payments by August will be issued, with a forecast of 26.2 billion euros versus the earlier 25.1 billion euros. UK public sector net borrowing in September are expected to increase by 5.7 billion pounds from 5.1 billion. In the US, home sales in the secondary real estate market are projected to decrease from 5.35 million to 5.30 million.

On Saturday, Fed Chair Janet Yellen will deliver a speech entitled "Monetary Policy from the Time of the Financial Crisis" at the National Club of Economists. Perhaps, she will talk something interesting for the moment. In the current situation, macroeconomic indicators, especially of secondary importance, are unlikely to affect the moods of large players. We are expecting for the euro at 1.1720, the pound is expected at 1.3010, then to 1.2950.

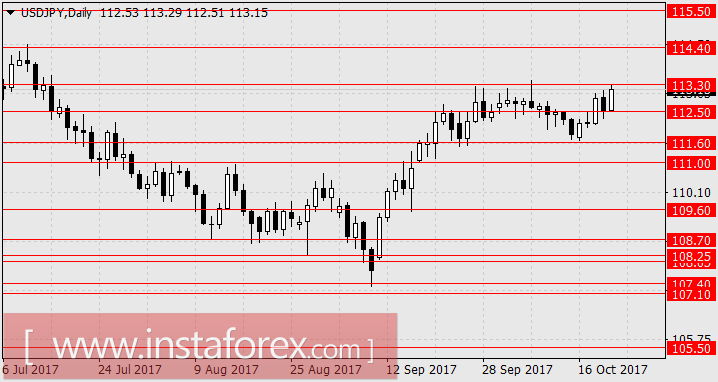

USD / JPY

The delayed reaction to changes in the broader moods of purchasing the dollar. However, it was declined during the Asian session together with the Australian dollar and gold, as the fall of the pound further accelerated. Yesterday, the Nikkei 225 grew by 0.10% today. Nevertheless, the index is growing for 14 consecutive days, which shows an optimistic data .

Despite the mixed trade balance yesterday, there was an opportunity for growth in general. The total balance for September was 670 billion yen versus 113 billion yen in August, while the balance with seasonal fluctuations decreased from 0.31 trillion yen to 0.24 trillion.

The elections of the Japanese parliament will be held on Sunday. According to the preliminary data, the power party can get 60-65% of the vote, which will enable Shinzo Abe to form a majority government.

We are looking forward to an upbeat of the Japanese yen to 114.40 and to 115.50 higher.