Prior -0.7%

- Market index 794.2 vs 798.9 prior

- Purchase index 304.6 vs 311.1 prior

- Refinancing index 3,620.5 vs 3,612.3 prior

- 30-year mortgage rate 3.02% vs 3.00% prior

The drop last week mainly stems from a fall in purchasing activity, as the more robust levels seen in the past few months is starting to lose a bit of steam going into Q4.

Further Development

Analyzing the current trading chart of EUR/USD, I found that buyers are in contorl today and the there is strong momentum to the upside as I expected yesterday.

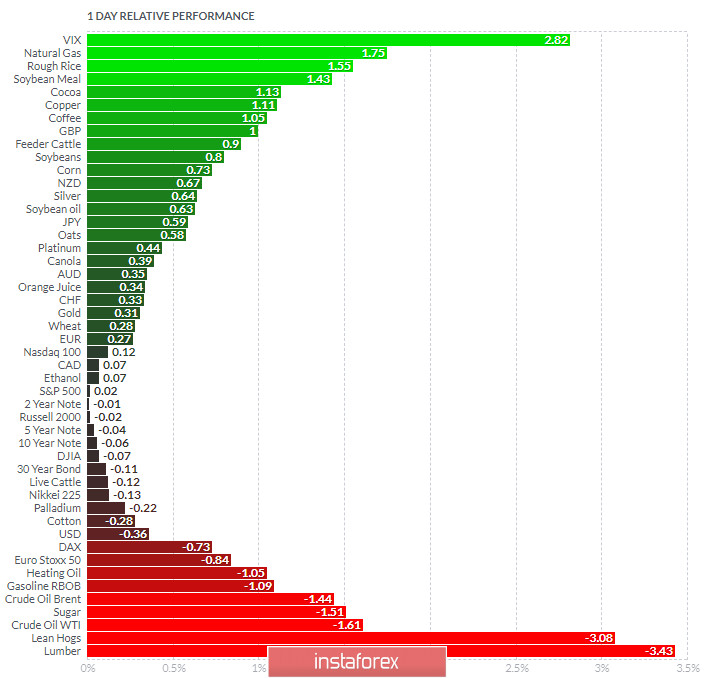

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got VIX and Natural Gas today and on the bottom Lumber and Lean Hogs.

EUR is holding well and it positive on the 1day relative base...

Key Levels:

Resistance: 1,1905 and 1,1200

Support level: 1,1825