The unexpected result of the "coalition" in New Zealand provoked a strong volatility in the NZD/USD pair. The market was openly unprepared for the fact that political forces that have been in the opposition for about nine years would stand "at the helm" of the state. The country was on the verge of big changes in many spheres of life since the new coalition government has its priorities different from those of its predecessors. These changes will most likely affect the central bank of the country. Against the backdrop of such prospects, the New Zealand dollar fell in price throughout the market and testing the 69th figure in tandem with the dollar.

After the parliamentary elections, the victorious parties held political negotiations for about a month. The ruling New Zealand National Party won a nominal victory but did not receive an absolute majority which forced them to seek temporary allies. Although experts considered different formats of the coalition agreement, almost all of them were confident that the new government would be created on the basis of the National Party. This would mean that the country will not feel any significant changes since this political force has been in power since 2008.

Yet, the negotiation process ended very unexpectedly. The holders of the "golden share", the representatives of the New Zealand First Party, joined not as the formal winners of the parliamentary race. Instead, they took part as the Laborites who had been in opposition for almost 10 years. Ironically, a small but ambitious party, which only received nine seats in the parliament, decided the fate of the coalition agreement. They influenced the development of the country by 180 degrees in a political way. The 37-year-old Labor leader, Jacinda Ardern has become the new prime minister and has already announced a number of cardinal changes, including the Reserve Bank of New Zealand. The national currency reacted to this fact with a very cheap price just after a few days, whereas the NZD/USD pair fell by 250 points that completely modified the technical picture.

What is the reason for a very rapid decline of the New Zealand? Firstly, it is the plans to change the law on the Central Bank of the country. This is a double mandate similar to the US Federal Reserve: monitoring and controlling inflation trends and achieving maximum (full) employment. First of all, the expansion of the targets is one thing where a soft monetary policy will continue to exist, without any prospects for changes in the near future. In addition, the partners in the coalition agreement insist on regulating the exchange rate of the national currency, considering the cost exaggerated. The weakening of the New Zealand dollar will have a positive impact on the country's exports. On the other hand, the proposed anti-immigration measures can completely offset the positive developments.

It should be noted that all the proposals under discussion are declarative in nature. However, possible changes will radically change the existing system. Therefore, the New Zealand dollar is actively losing its positions. As a rule, such emotional events have a strong, but transitory impact. The southern trend is unlikely to be reversed, but not excluding the correctional growth since there has been no recoil of an almost 300-point drop.

However, fundamental conditions are also necessary for terms of a correction. First, the "political passions" and loud slogans must be calmed down when the question on reforming the RBNZ will pass into a long stage of parliamentary discussion. The New Zealander will switch to other factors and pair with the US dollar when there are events from America. Here the focus of attention is focused on two issues. First, the question of who will succeed Janet Yellen. Secondly, whether the predictions are confirmed the reduction of US GDP in the third quarter. Donald Trump stands "a theatrical pause," who is not in a hurry with the announcement of its candidate for the post of the head of the Fed. According to speculations, he will do it before the end of next week on the eve of his Asian tour. The market discusses the four probable candidates, who to some extent "suit" dollar bulls.

However, the release of data on GDP growth from the U.S. is dated on October 27, which would be the nearest Friday. The consensus forecast says that in the third quarter the country's economy will grow by only 2.7% compared to the indicator on the second quarter which is 3.1%. If the release figures will be achieved on the projected level, traders are likely to ignore it despite the actual decline. Enormous damage from major storms will affect the dynamics of GDP growth, which is a fact that investors have already taken into account in his calculations. Alternately, if the economic slowdown will be more widespread, it will negatively affect the US currency.

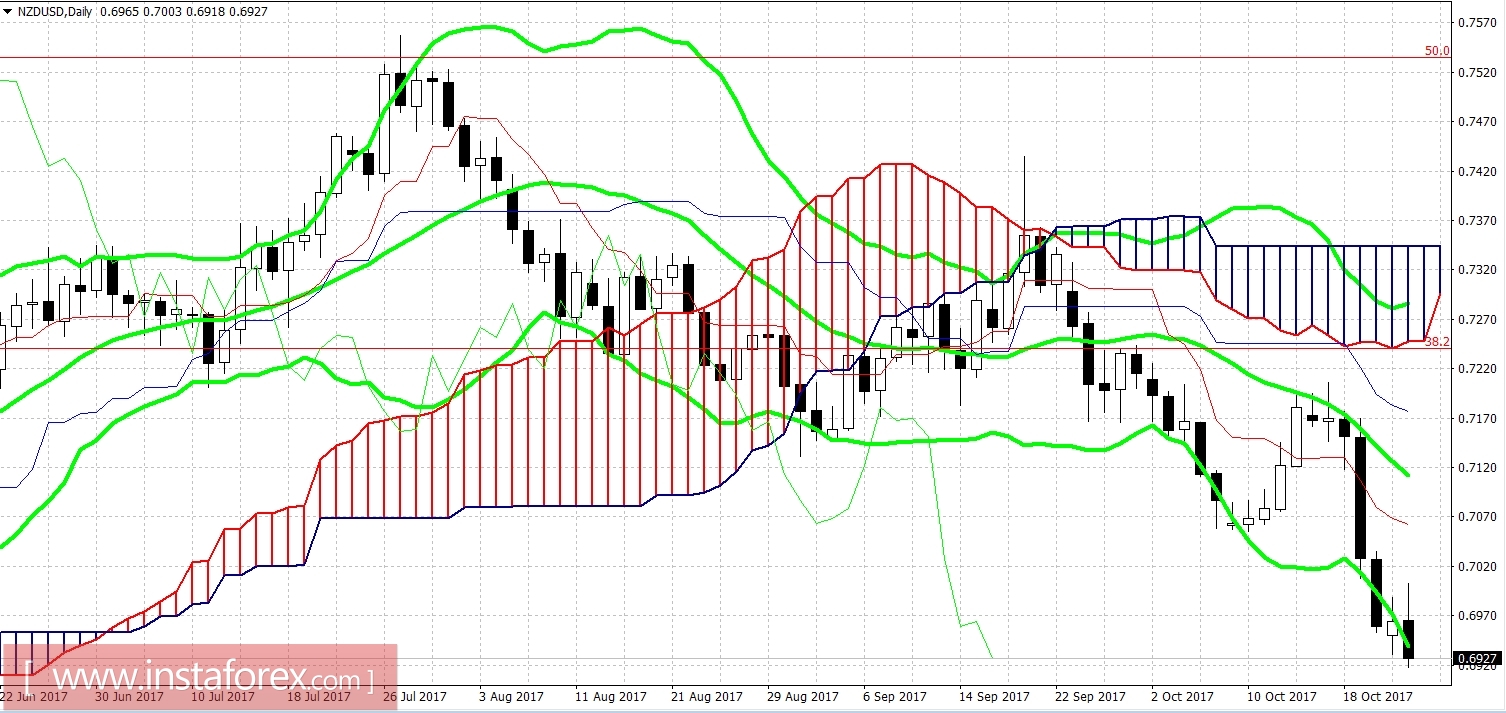

Thus, the NZD/USD pair has a chance of a corrective growth due to the possible weakening of the US dollar, despite the pronounced southern trend of the pair. From the technical point of view, the Ichimoku Kinko Hyo indicator formed a bearish signal in a form of "Line Parade". Moreover, the price is below the bottom line of the indicator Bollinger Bands found on the same timeframe, which also speaks of the force of the downward movement. Strong resistance levels are located at 0.6817 which is the low of this year and the level of 0.6770 which is the bottom line of the Bollinger Bands indicator on the monthly chart. When these marks are reached, long positions can be considered in the context of a corrective rollback.