EUR / USD, GBP / USD

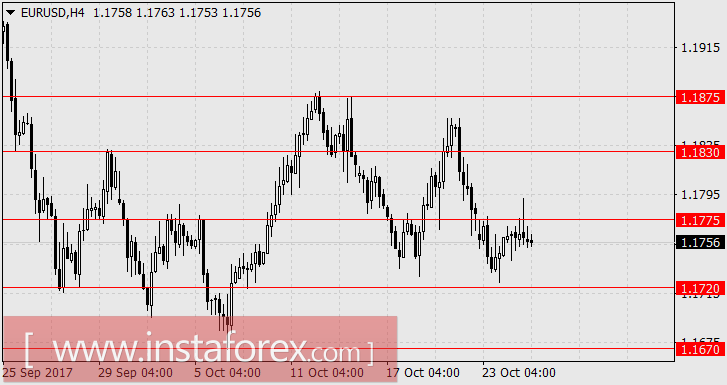

The distinctive feature on Tuesday was the growth of the euro against the decline of other major currencies. The single European currency further increased against the fall of gold down to -0.22% and the stock market grow through the Dow Jones at 0.72%. The EUR also rose against mixed economic indicators. The business activity in service sphere for October decreased from 55.8 to 54.9 and the PMI in the production sphere increased from 58.1 to 58.6. It further boost the euro against good US indicators which includes the services PMI that increased from 55.3 to 55.9, and the Manufacturing PMI that rose from 53.1 to 54.5. In fact, business activity in the manufacturing sector of Richmond fell from 19 to 12 in the same month. The Euro remained steady in its place till the ECB meeting.

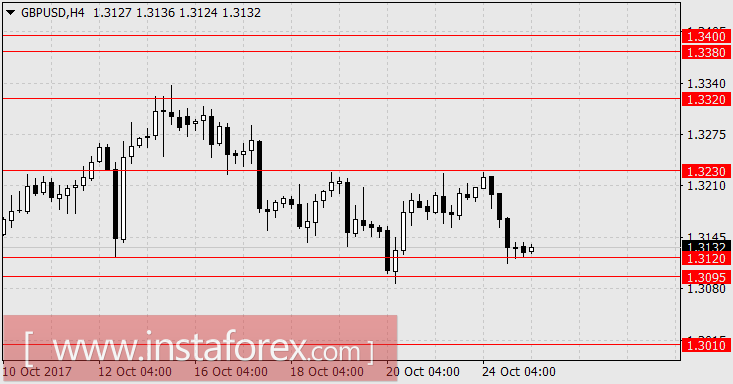

The British pound was pressured by the news about high chances that the UK will leave the EU without a trade agreement with 25% in September and 30% in October poll by Reuters. In connection with the prevailing negative sentiments, the today's perception of GDP data in the 3rd quarter may differ against the assumptions yesterday, which is the projected decline from 1.5% YoY to 1.4% YoY perceived as a bearish factor. The quarterly growth is projected at 0.3% in the second quarter.

According to the United States, the expectations are mixed but generally positive. The volume of durable good orders in September is projected to grow by 1.0%, with the base volume of orders (excluding transportation) expected to increase by 0.5%. There could be a significant weakness in the sales of the primary housing market, with a forecast of 555K against 560K in August. In case the forecast was fulfilled, it will be the third decline in a row. But there is also a "cushion" here, as the market grew stronger against the prediction, then there would be a sharp increase in subsequent sales for the months of October and November at a post-hurricane factor.

We are expecting for the pound to overcome the range of 1.3095-1.3120 with a subsequent decline towards 1.3010. The euro could possibly decline to 1.1670, after which the prospect opens to 1.1580.

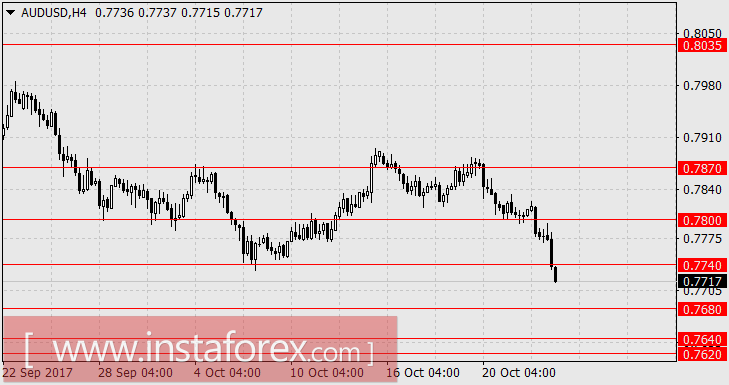

AUD / USD

While in Europe, investors were influenced by the degree of softness or hawkishness of the ECB's monetary policy decision tomorrow, as the New Zealand dollar is losing more than 300 points in the last eight days and the Australian dollar, on the other hand, is down by 170 points. Yesterday, the "Australian" lost 30 points against the background of oil growth by 1.5%, the growth of iron ore is up by 0.7% and an increase in the coal price by 0.7%. Non-ferrous metals and prices grow except for gold and silver.

Today, a decent amount of oil in the onset of the Asian stock exchange flowed inflationary data on Australia. The consumer price index for the third quarter gained 0.6% against expectations of 0.8%. On an annualized basis, the CPI fell from 1.9% YoY to 1.8% YoY, with expectations of growth to 2.0% YoY. Currently, the RBA lacks confidence about raising the stakes are starting to develop. Based on the data, the AUD / USD lost more than 50 points. Given the continuing trend of strengthening the US dollar, we are expecting for the "Australian" in the range of 0.7620 / 40.