The Australian dollar fell sharply against the US dollar after the release of weak data pointing to a moderate increase in inflation in the 3rd quarter of this year. This suggests that in all likelihood, interest rates in the country will remain unchanged over the next year. Thus, to count on the growth of the Australian dollar, relying on a change in only one monetary policy, will not be an entirely correct decision.

The Australian dollar was not helped by the speech of the Secretary of the Treasury of Australia, who said that Australia's economic growth has become more balanced, and inflation has slightly increased over the past 12 months. He also drew attention to the fact that the growth in housing prices has become more moderate, but it is too early to talk about the results of restrictions in the field of mortgage lending.

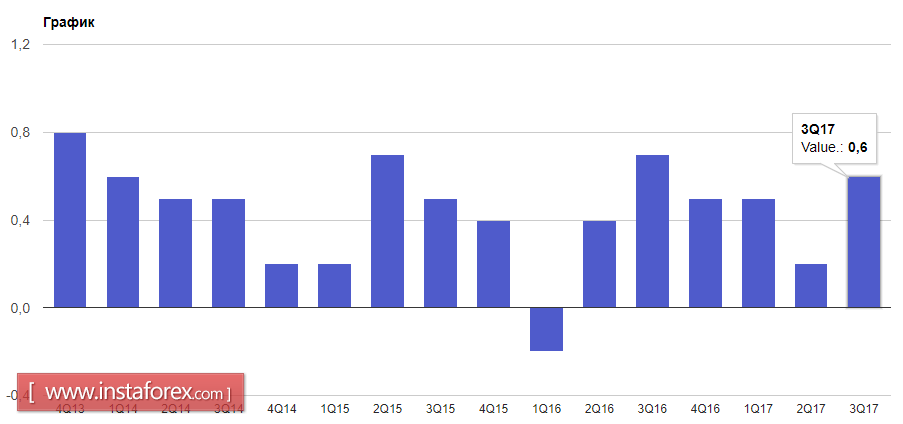

According to the report of the statistical agency, Australia's consumer price index in the third quarter of this year grew by only 0.6% compared to the previous quarter, while a number of economists expected a larger increase in the area of 0.8%.

Compared to the same period in 2016, the consumer price index rose by 1.8% against the forecast of 2.0%. As noted in the report, the main reason for the decline in the indicator was the decline in prices for vegetables, although the rise in price for electricity slightly offset this trend.

As for the technical picture, going beyond the support of 0.8000 seriously hit the positions of buyers, and now the movement is moving towards a new level of 0.7650, where large players will try to form a stop of the downward trend, the main goal of which is the 0.7550 area.

The European currency continues to trade in a narrow lateral channel paired with the US dollar. Good data to reduce the number of unemployed in France had only temporary support for the euro yesterday, at the end of the North American session.

According to the Ministry of Labor, the number of unemployed in France in September this year fell by just 1.8%, to 3,475,600. Apparently, the reforms that the new government of President Macron is conducting are giving the first results.

Many traders also refrain from active trading amid a lack of important fundamental statistics and are waiting for the decision of US President Donald Trump regarding the candidacy for the Fed chairman. Recently, Trump again did not name any terms and did not hint at possible candidates, but said he would announce his decision in the near future.