The Bank of Canada at its meeting yesterday retained the parameters of the monetary policy in its previous form, and the announced results of the meeting left more questions than answers. However, one clear conclusion can still be made: the interest rate will not be increased this year. As for the future prospects, it look very vague, given the comments of the regulator's members.

The worst assumptions of the bears of the USDCAD pair have been confirmed: the Central Bank of Canada is not ready to maintain the given pace of tightening monetary policy. There are many reasons for such indecision, they can be divided into two parts: internal and external.

First, the regulator is concerned about low rates of inflation growth. While the consumer price index grew in September, it showed a weak dynamic (only 0.3% gain on a monthly basis). In addition, after five months of growth in Canada, the retail sales decreased - excluding automobile sales. The decline in consumer activity is associated with a rise in the price of the national currency - from June to September, the Canadian dollar against its US counterpart has strengthened by more than a thousand points, which affected the inflationary trends.

Previously, the Bank of Canada "did not notice" the strong growth of its currency, however, at yesterday's meeting it was focused on this issue. The regulator associated the risk of weak inflation with the exchange value of the currency: in this context, the central bank moved the projected timeframe for achieving the target inflation rate for the second half of 2018.

Weak price pressure is not the only problem for the Bank of Canada. There is also a larger issue, which is not so much in the economic as in the political aspect. This is the North American Free Trade Agreement (NAFTA). It should be noted that since the middle of August, on the initiative of Donald Trump, negotiations have been held between Canada, Mexico and the United States on the revision of the terms of this agreement.

The American president threatened to withdraw from the deal (which was brokered in 1994), considering the current conditions as "dishonest." After Trump's visit to Canada, an agreement was reached on finding a compromise - and this search began on August 16. In total, seven stages of negotiations are planned with three-week breaks. The final round should be held early next year: according to the preliminary agreement of the participants of the round table, the negotiations will end before the beginning of the presidential campaign in Mexico (the elections there are scheduled for July).

The parties are discussing the revision of the agreement for several months, but the effectiveness of the negotiation process is close to zero. Last week, the fourth round of talks ended, the results of which disappointed the markets. The Minister of Foreign Affairs of Canada actually accused the American side of having a destructive proposition, which is characterized by the phrase "the winner gets everything".

Americans proposed openly unfavorable conditions for other countries, which in some cases are against the rules of the World Trade Organization. For example, Washington plans to allow duty-free importation into the territory of the country only those of cars, more than 50% of which were manufactured in the US. This is an eloquent example of how Trump implements his slogan "America First" as part of the revision of the North American agreement. Canadians are categorically against such a dominant role, so the negotiation process at the moment actually came to a standstill.

In November, the parties will meet again, but hope for any significant breakthrough is not worth it. It is unlikely that Trump will depart from his conditions, despite the complete rejection of Canada of such terms. According to the Canadian minister, the US demands "will weaken the productivity of North America and will destroy thousands of jobs in all three countries." Similar characteristics indicate that the parties are still very far from reaching a compromise.

Under such uncertainty, the Bank of Canada can not and will not tighten monetary policy. The agreement under discussion is too important for the Canadian economy, particularly in the labor market. A cardinal revision of the terms of the treaty and/or the withdrawal of Americans from NAFTA is filled with consequences. Customs barriers will increase and the flow of investment will decrease. And this is not a complete list of possible problems.

Thus, the Canadian currency will now react not only to inflation and the oil market, but also to the tripartite negotiation process. If the next round of negotiations ends in failure, the Canadian will continue to become cheaper throughout the market.

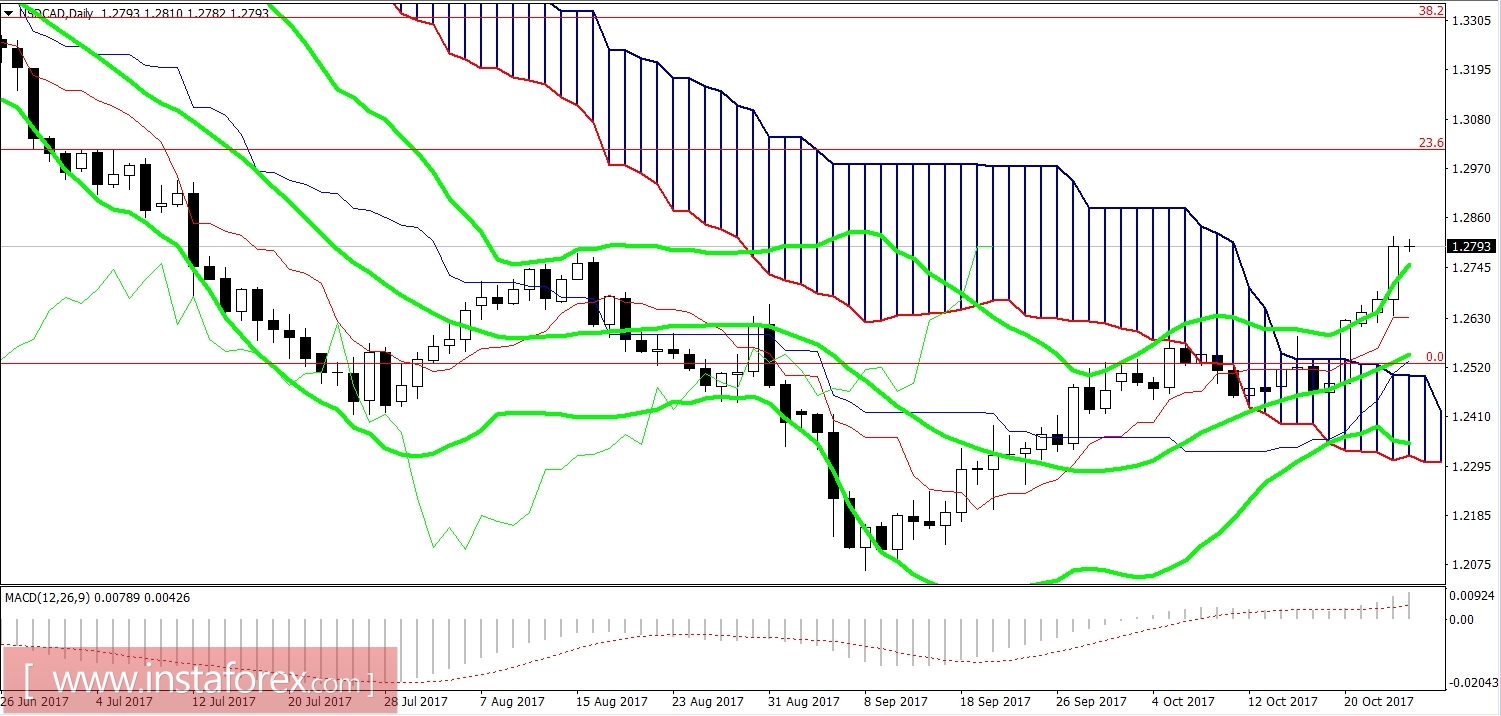

In terms of the technical picture, the growth of the USDCAD price is also justified. First, the indicator Ichimoku Kinko Hyo on the daily chart has generated a bullish "Line Parade" signal. Secondly, the pair is trading above the upper line of the indicator Bollinger Bands, which also reflects the upward movement. Third, the price is located above the cloud Kumo indicator Ichimoku Kinko Hyo. Thus, the main indicators indicate the advantage of the northern direction. The support level is the line Tenkan-sen indicator Ichimoku Kinko Hyo and the price of 1.2635. And the resistance level is the Kijun-sen line on the weekly chart, which corresponds to the level of 1.2920.