EUR / USD, GBP / USD

So, the ECB did not deceive the markets and did what was expected of it. It announced the reduction of asset purchases from 60 to 30 billion euros a month with the extension of the program until September next year. The interest rate will remain low for a long time after the completion of the entire QE program. For the large extent, the markets were ready for such a decision and the news on the rate supported the discrepancy in the monetary policy between the ECB and the Fed. The euro fell by 160 points. The pound sterling, following the euro, lost 100 points. The consumer climate index in Germany from GfK for November fell from 10.8 to 10.7 with the expectation of the indicator remaining unchanged. The balance of retail sales in the UK from the CBI for October crashed from 42 to -36. This is the worst data since March 2009. Released US indicators on trade balance, wholesale inventories, and unfinished sales in the secondary housing market were all slightly worse than expectations but they did not affect the decision made by investors. The news was also unchanged regarding the Federal Reserve Bank of Atlanta who lowered the forecast for US GDP for the third quarter from 2.7% to 2.5%.

It is today that the first estimate of the US GDP for the third quarter will come out. The consensus forecast is 2.5% -2.6%. This is quite a good figure. Over the past seven years, it was only nine blocks higher. The lower house of Congress yesterday voted for the "Trump budget", previously adopted by the Senate. Of course, we expect an active continuation of the strengthening of the dollar. For the euro, the target is the level of 1.1485-1.1510. For the pound sterling, the target is the range of 1.2990-1.3030.

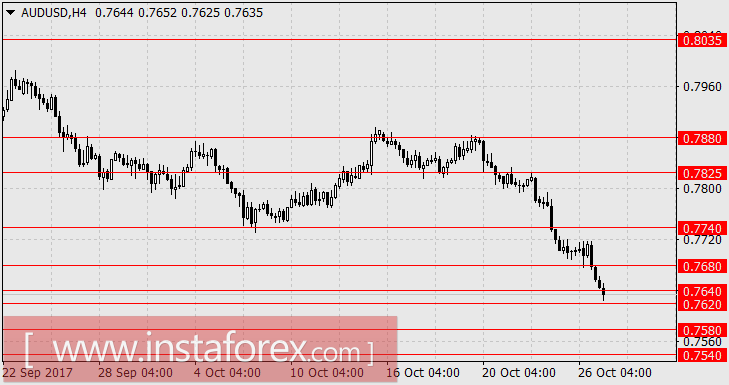

AUD / USD

Against the backdrop of the active fall of the euro and the pound, the Australian dollar could only continue to fall. This made the Aussie and the New Zealand dollar weak for a week. In the third quarter, export prices in Australia fell by 3.0% with the forecast was even worse at -6.3%. Import prices showed a decline of -1.6%. Prices for raw materials with a large-scale strengthening of the US dollar also fell. Iron ore fell by -1.2%, coal dropped by -0.1%, copper lowered by -0.3%, and gold slumped by -0.8%.

Today's data on producer prices turned out to be worse than forecasts. In quarterly terms, they increased by 0.2% against the forecast of 0.4%. At an annual rate, the data was at 1.6% against 1.7% in the second quarter.

Yields on Australian government bonds are increasing in profitability but their growth is less than the growth of US securities. At the beginning of next week, a new stimulant is expected to strengthen the US dollar on data on income and expenditure of consumers. September incomes are expected to grow by 0.4% while expenses are expected to add 0.7%. The consequences of the hurricanes will not make you wait. The forecast for new jobs in the non-agricultural sector in October is expected to increase by 300 thousand, the highest value since January 2015.

The further decrease in the "Aussie" is seen to go to the levels of 0.7580 and 0.7540.