Again, the excessive expectations of the market brought the European currency. The euro-dollar pair is updating the July lows, and the technical picture confirms the probability of further downward movement. The October meeting of the ECB turned out to be too "soft" for traders, and the inconsistency of the regulator's members only aggravated the situation. The "pigeon" rhetoric of the head of the European Central Bank was not a surprise. The market was ready for the fact that he verbally tried to neutralize the effect of decisions made by the regulator. He did it. He convinced the market that the ECB will stick to a soft monetary policy for a long time, and the QE program "has a certain form of flexibility" if the current conditions become less favorable. The rate of completion of the stimulant program turned out to be rather slow. First, until the end of this year, the regulator will continue to buy bonds for 60 billion euros a month. Next year, this figure will be halved, but the program will last almost a year until September. Secondly, the Central Bank said that after that, it can again extend the validity period of QE, depending on the current situation. In this respect, the regulator is not limited by any time frame. Such a measured rate of folding program (and even with the possibility of prolongation) disappointed traders, although such a scenario was predicted by many experts.The issue of raising the interest rate is also postponed "in the long run". According to Draghi, the rates will remain at the current level "for a long time after the completion of QE." In other words, the most probable term of the first rate increase is 2019, provided that the target inflation level is reached. Another unpleasant moment is the lack of a unified position among the regulator's members. The head of the ECB acknowledged that the decision on QE was not unanimous, and "different points of view" were expressed on this issue. At the same time, he did not specify which nuances were the subject of disagreement. In this case, it is necessary to wait for the release of the minutes of the October meeting to understand the essence of the contradictions. Obviously, we are talking about the details of the completion of the program, because the fact of folding QE by none of the regulator's members was contested. Moreover, as Mario Draghi assures, this decision was made "on the positive", given the decrease in unemployment and the growth of the average wage in the EU. He added that such dynamics are conditioned by support from the ECB monetary policy. In his opinion, the euro-zone economy needs support, especially against the background of restrained price pressure. Draghi once again complained about the unstable growth of inflation, the indicator of which now "tramples" at 1.5%. This fact is another argument for maintaining a soft monetary policy. Thus, the bulls of the euro-dollar pair did not have a single chance to strengthen their positions. Of all the possible scenarios, the most "soft" one was implemented yesterday. The bears seized the initiative and lowered the price to the borders of the 15 figure, redrawing the technical picture at the same time. After all, in addition to the "pigeon" meeting of the ECB, the pressure on the pair was also provided by political events in Spain. Mario Draghi (who, as a rule, avoids similar topics) said that the European regulator "very carefully" keeps track of this issue, although it is still premature to talk about the risks of financial stability. Also, the head of the ECB said that "it is difficult to comment on the situation that is changing every day." Political events there do occur with kaleidoscopic speed. Literally today, the Parliament of Catalonia is holding a final debate on the referendum, while Spanish Prime Minister Mariano Rajoy convinces the senators to vote for direct government over this region. The political crisis is again entering into the sharp phrase, putting additional pressure on the euro, especially in the light of comments by Mario Draghi. But the US dollar feels quite confident, relying primarily on the prospects for tax reform. Following the Senate, the Congress voted for the next year's budget. This fact increases the likelihood of accepting the tax changes proposed by Trump. Some support for the dollar and rumors associated with the choice of candidacy for the head of the Federal Reserve. Over the past two weeks, the most likely candidate is "centrist" Jerome Powell. However, recently in the American press, there was information that among the Republicans, Stanford University professor John Taylor is very popular. He is known for his "hawkish" position, which he has consistently defended for many years. If Trump still stops at his candidacy, the dollar will rise in price significantly throughout the market.

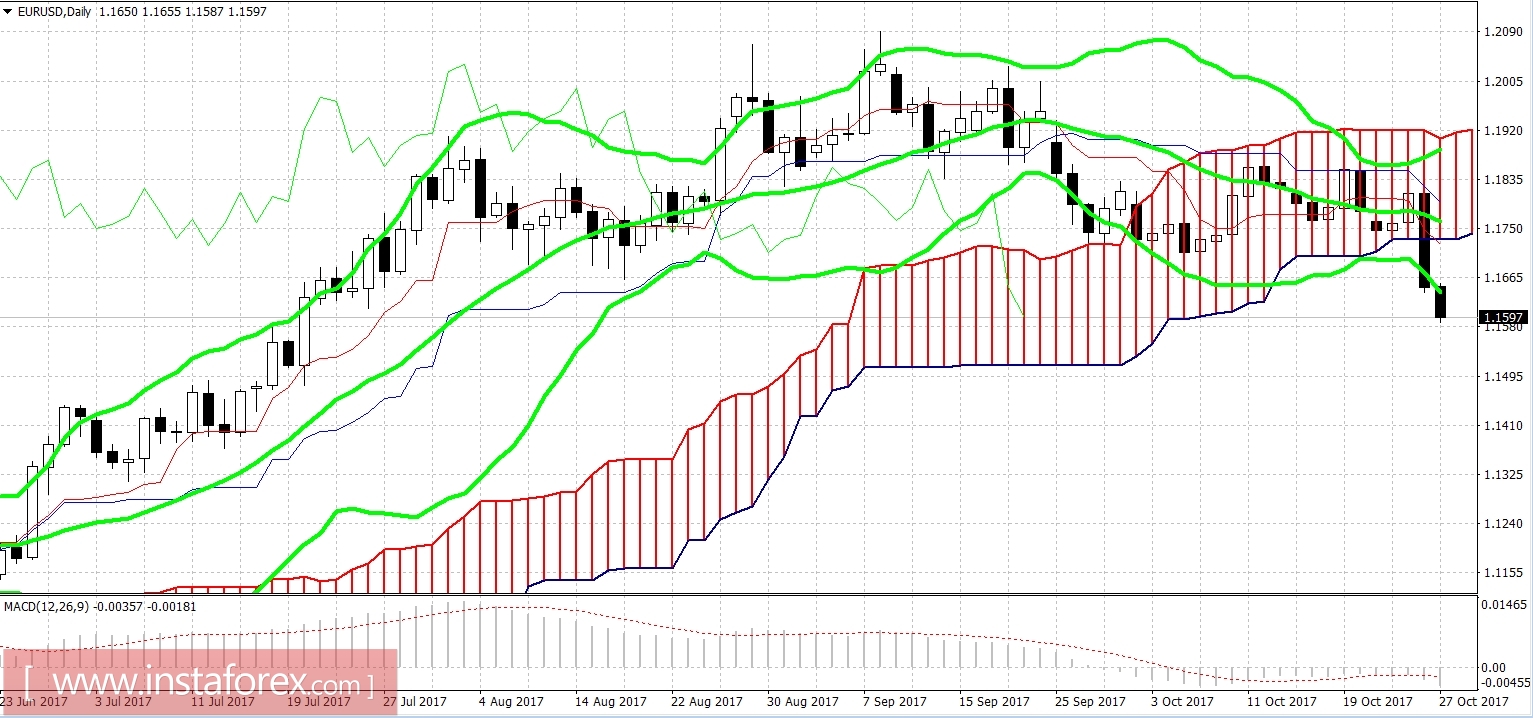

However, let's return to the nearest prospects of the euro-dollar pair. The most urgent question now is what is the "depth of fall"? The daily chart tells us that the indicator Ichimoku Kinko Hyo formed a strong bearish signal "Line Parade", while the price is testing the bottom line of the indicator Bollinger Bands. To determine the objectives of the southern movement, let's move to a weekly chart. So, the nearest level of resistance is the mark of 1.1460, this is the line Kijun-sen indicator Ichimoku Kinko Hyo. The next target level is the price of 1.12.30, this is the bottom line of the Bollinger Bands indicator on D1.