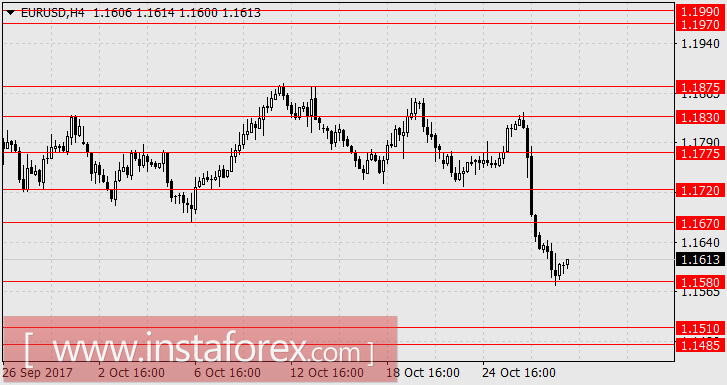

EUR/USD, GBP/USD

On Friday, the first assessment of the US economy for the third quarter gave a pleasant surprise - GDP showed an increase of 3.0% against the forecast of 2.5-2.6%. And if the hurricanes "Harvey" and "Irma" could not negatively affect GDP, the restoration of the devastation provides a prospect of GDP growth in the 4th quarter of more than 3%. Consumer spending in the third quarter increased by 2.4% against expectations of 2.2%. The consumer sentiment index from the University of Michigan for October increased from 116.4 to 116.5 against expectations of a decline to 116.1. The index of consumer expectations from the same institute dropped from 91.3 to 90.5. Against the background that Catalonia declared independence after the introduction of direct management of the region by Madrid, the euro fell 42 points on Friday. The pound lost 31 points. The market is still discussing potential candidates for the chief of the Fed, and many are inclined to believe that any one of the three candidates (Yellen, Powell, Taylor) will have a positive effect on the dollar.

Moderately-positive data on the eurozone are expected today. The volume of Germany's retail sales for September is projected to grow by 0.5% after -0.2% in August. Germany's CPI in October is expected to increase by 0.1%, but a decline of 1.8% can be annualized to 1.7% y/y. Spain's GDP for the third quarter may show an increase of 0.8% (3.2% y/y vs. 3.1% y/y earlier). In the UK, the net volume of new loans granted to individuals in September, could be reduced from 5.6 billion pounds to 5.5 billion pounds, the number of loans might be reduced to 67,000 to 66,000.

In the US, personal income of consumers in the September estimate may increase by 0.4%, personal expenses may increase by 0.8%. The figures are expected to be quite high, if justified by the forecast for spending, this will be the best figure since April 2016. It was only five times higher for the entire post-crisis period.

We are waiting for the euro in the range 1.1485-1.1510, pound sterling at 1.3030 and 1.2990.

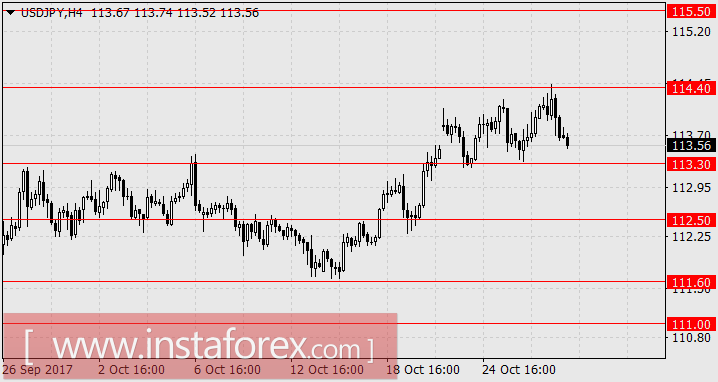

USD/JPY

Despite the positive data that was released on Friday in the US and the strong growth of the stock indices (S&P 500 0.81%, Dow Jones 0.14%, Nasdaq 2.20%), the yen lost 28 points on Friday and today 10 more points in the Asian session. The Japanese Nikkei 225 index added 0.07%. Obviously, the pressure comes from the Chinese market, where the Shanghai Composite lost 0.73%, and China A50 added 0.21%. In Japan itself, investors were disappointed with the retail sales figures. The September index increased by 0.8%, which after the collapse in August by 1.7%, does not appear very optimistic, and on an annualized basis, growth was 2.2% y/y against the forecast of 2.5% y/y, although in general there is an increase (from 1.8% y/y earlier).

Tomorrow, household spending for September are expected to grow by 0.7%. The unemployment rate may remain at the current 2.8%, but industrial production is expected to decline by 1.5% after a previous growth of 2.0%. The main event will be the Bank of Japan's decision on monetary policy and the subsequent press conference of the head of the Central Bank, Haruhiko Kuroda (5:30 London time). Earlier, the Bank of Japan reassured the business community that the policy so far remains unchanged. Repeating this belief will send the yen further upwards. Objective 115.50.