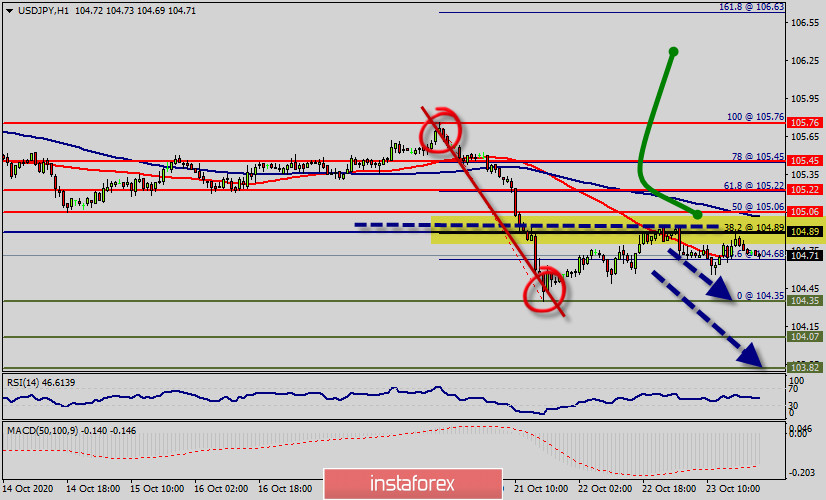

The trend is still trading around the key level of 104.89 which represents with the daily pivot point on the H1 chart.

Bullish outlook :

The USD/JPY pair is continuing in a bullish market from the supports of 104.68 and 104.89. Also, it should be noted that the current price is in a bullish channel.

Equally important, the RSI is still signaling that the trend is upward as it is still strong above the moving average (100) since yesterday. Immediate support is seen at 104.89 which coincides with a ratio (23.6% of Fibonacci).

Consequently, the first support sets at the level of 104.89. So, the market is likely to show signs of a bullish trend around the spot of 104.89.

In other words, buy orders are recommended above the pivot point (104.89) with the first target at the level of 105.22.

Furthermore, if the trend is able to break through the first resistance of 105.06.

The movement is likely to resume to the point 105.22 and further to the point 105.22. As a result, the pair will climb towards the double top (105.76) to test it.

Bearish outlook :

The USD/JPY pair will drop sharply from the 104.89 level towards 104.68 in case a breakout at the 0.9915 (daily pivot point). It should be noted that the volatility is very high for that the price of the USD/JPY pair is still moving between 104.89 and 104.35 in the coming hours.

Additionally, currently the price is in a bearish channel. According to the previous events, the pair is still in a downtrend. From this point, the USD/JPY pair is continuing in a bearish trend from the new resistance of 104.89.

Thereupon, the price spot of 104.89 remains a significant resistance zone. Therefore, the possibility that the Yen will have a downside momentum is rather convincing and the structure of the fall does not look corrective.

In order to indicate a bearish opportunity below 104.89, it will be a good signal to sell below 104.89 with the first target of 104.68. It is equally important that it will call for downtrend in order to continue bearish trend towards 104.35.