The US economy continues to gain, as indicated on Friday's published data on GDP for the third quarter.

Preliminary data on US GDP for the third quarter showed the continuation of the economic growth trend, which in fact is an unusual phenomenon in recent years following the acute phase of the 2008-09 crisis. This is when the economy grew by the middle of the year, but eventually surrendered to its end. Growth in the third quarter was 3.0% vs. 3.1% in the second quarter and expectations of a slowdown in the third quarter to 2.5%. Observing such dynamics, it can be argued that combined with a strong labor market it will lead to an increase in inflationary pressures, which means that whomever D. Trump decides to appoint as the next head of the Fed, the regulator will have to act in line with the current paradigm, following the normalization of the monetary- credit policy, accompanied by an increase in interest rates.

Another important event of the week was the ECB's decision to smoothly exit the quantitative easing program. This news shocked market participants who believed that the European regulator, considering the positive changes in the region's economy and looking at how the Fed operates, without waiting for the consumer inflation level to reach the 2.0% mark, will announce the termination of the program of measures stimulation by the end of next year. However, this did not happen, the bank decided not to take risks, which immediately affected the rate of the single European currency, which lost more than two figures on Thursday and Friday against the dollar.

A change in sentiment in the currency markets not in favor of the euro indicates that it is likely to continue a gradual decline on the wave of incoming positive data from the US. It can be assumed that by this week, if the figures for employment in the United States shows a rebound, it will put new pressure on the main currency pair of the EUR/USD and it will fall below the 1.1400 mark.

The same picture should be observed in the USD/JPY pair against the backdrop of a renewal of discrepancies in monetary policy between the Central Bank of Japan, which will not rush to change the policy of the monetary policy and the Fed, which has steadily embarked on a course towards a rise in the cost of borrowing in an attempt to prevent a potential overheating economy in the future. On this wave, the pair will rush to a mark of 115.00 and even higher to 115.50.

Forecast of the day:

The EURUSD pair stopped above the level of 1.1600 in anticipation of a new portion of data from the US, as well as the appointment of a new head of the Fed. The new positive news will push the pair down first to 1.1550 after breaking through the level of 1.1585, then to 1.1485.

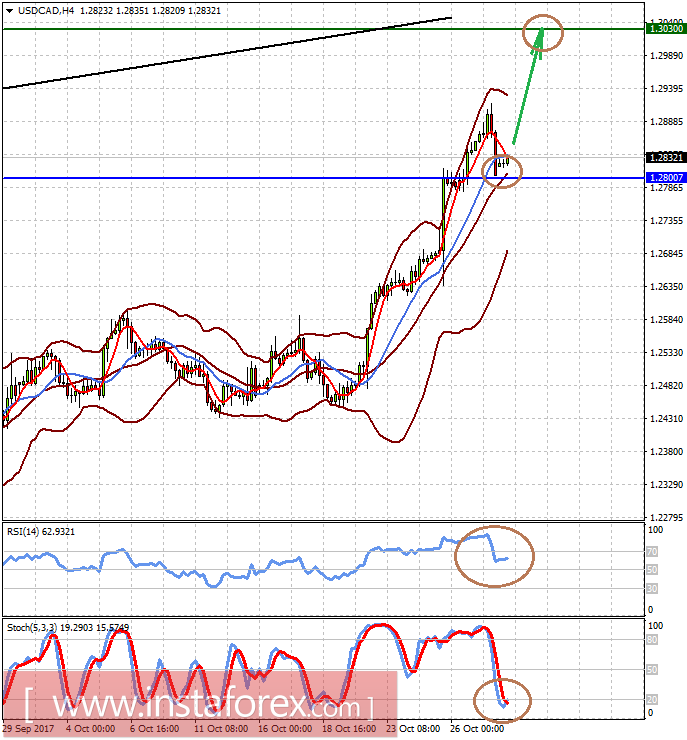

The USDCAD pair is adjusted to the level of 1.2800, but is trading above it. If this mark stands, you should expect the price to increase further to 1.3000, and then to 1.3030.