EUR/USD, GBP/USD

On Monday, high figures for consumer spending and incomes were published, but political factors did not allow the Euro-pound pair to develop further predetermined decline on Thursday and Friday. There was a report that the announcement of the candidate for the post of head of the Fed will take place on Thursday, and this candidate will be Jerome Powell. Since Powell is a traditional "dove," counter dollar currencies cheered up. Of course, this is not the case. Powell and another possible candidate, John Taylor - are representatives of the Republican Party, and Janet Yellen - a Democratic, represent the conflicting interests of their establishment. But earlier it was said that on the the matter of Yellen's candidacy the parties managed to agree, and if nothing in the mood of the White House has changed, then Janet Yellen can still be appointed for a second term. A clear sign of this is the constant change of focus from one candidate to another. But even if Powell will be appointed to this post, this will mean the continuation of the current, in fact soft, Yellen policy, so necessary to finance the budget deficit. The debt of the United States on October 27 was already 20.454.137 trillion dollars.

But an even bigger disappointment to investors could be brought by the news about the extremely slow and step by step introduction of a reduced rate on corporate income tax of 20%, the final figure of which can only be secured in six years.

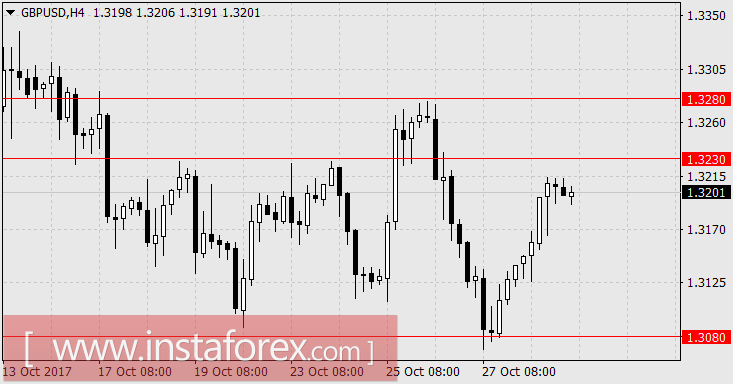

So, despite the very high growth in consumer spending (1.0% vs. expectations of 0.8%), the euro increased by 43 points, the British pound by 78 points, reassured by slightly better data on lending and positive expectations of rate hikes at the nearest meeting of the Bank of England. The volume of consumer mortgage lending in September actually declined, the data surpassed only the forecasted values: the mortgage volume was 3.85 billion pounds against expectations of 3.6 billion pounds and the 3.93 billion pounds recorded in August, consumer lending amounted to 1.60 billion pounds against forecast of 1.50-1.60 billion pounds, but the previous figure was revised upward from 1.58 billion to 1.76 billion sterling pound.

Will the Bank of England raise the rate this Thursday? Markets expected an 80% chance of its increase from 0.25% to 0.50%. In fact, the expected increase in the rate will be nothing more than its return to the value before Brexit - then there was an extraordinary reduction in it to an unexpected turn of events, and the inflation figures currently discussed in the media do not really have anything to do with the intention to raise the rate. Earlier, attention was focused on the likelihood of an increase as well, for the purpose of being more prepared to reverse the Fed's example in the case of a new crisis. Obviously, large investors have a full understanding of the policy of the Bank of England, and if the rate increase is already incorporated in prices, then a significant increase in the pound may not materialize. However, there are good opportunities for major players to conduct trading on the freeing of money from middle-class players. Probably increased volatility.

Today, there are significant data on the euro area. In the first estimate, GDP for the third quarter is expected to be 0.5% versus 0.6% in the second quarter. The base and total CPI for October are expected to remain unchanged, at 1.1% y/y and 1.5% y/y, respectively. The unemployment rate in the eurozone may fall from 9.1% to 9.0%.

In the US, the index of business activity in the manufacturing sector of the Chicago region in October is expected to decrease from 65.2 to 60.2, the index of consumer confidence from the Conference Board for the same month is forecasted to increase from 119.8 to 121.1.

The consolidation in the euro is expected, limited to above the level of 1.1670 (the transition to the range 1.1670-1.1720 is possible in the case of output of data very different from the projected ones). It is quite possible for the sterling pound to reach the range of 1.3230/80. The difficulty is to determine at what level investors are planning to meet the decision of the Bank of England- to attack in one direction or another. The visually designated range for such intentions is suitable.

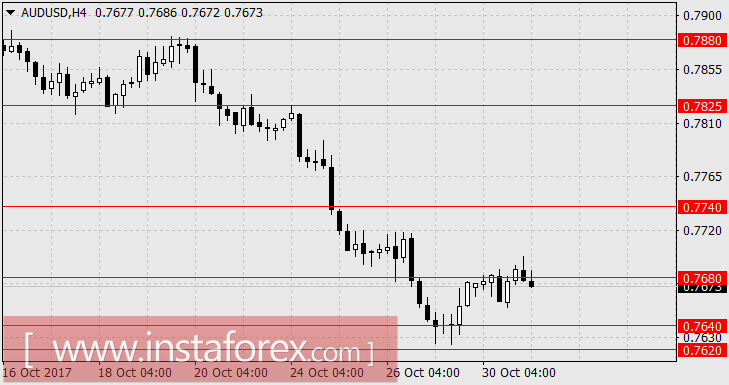

AUD/USD

The Australian dollar only slightly reacted to a new surge in sentiment in Europe. Meanwhile the US dollar's increase on Monday was 15 points. Today's economic data confirmed the accurateness of such caution. Sales of new homes in Australia fell by 6.1% in September, while private sector lending in September increased by 0.3, against expectations of 0.5%. The volume of mortgage lending showed an optimistic growth of 0.5%. But in China, the PMI in the October estimate fell from 52.4 to 51.6 and non-manufacturing PMI declined from 55.4 to 54.3.

The commodity market as a whole is restrained and multidirectional. Gold and oil have grown, iron ore has decreased by 2.2%. Non ferrous industrial metals also show mixed dynamics. Expect the price of AUD/USD in the range of 0.7620/40.