Traders of commodity currencies ignored the manufacturing activity data in China, which was slightly changed compared to the previous month.

According to the report, the private indicator of Chinese production activity in October this year remained unchanged compared to September, which maintains stability in the sector. The final index of supply managers for China's manufacturing sector came in at 51.0 points, which further coincided entirely with the economists' forecasts.

The New Zealand dollar rose strongly against the US dollar after the release of the report, which shows falling unemployment rate in New Zealand.

According to the Bureau of Statistics of New Zealand, the unemployment rate in the country declined in the third quarter to 4.6% compared with 4.8% in the second quarter of this year. Economists predicted that the unemployment rate will be 4.7%. The share of economically active population was 71.1% against 70% in the previous quarter, and the number of employed in New Zealand increased by 4.2%.

This data helped the NZD/USD pair to push off serious lows and was able to establish good support in the 0.6820-0.6830 area. This could lead to a larger rebound of the trading instrument upwards, after its prolonged fall for 10 consecutive days. You can rely on the correction initially in the area 0.6900 and for the update 0.7000.

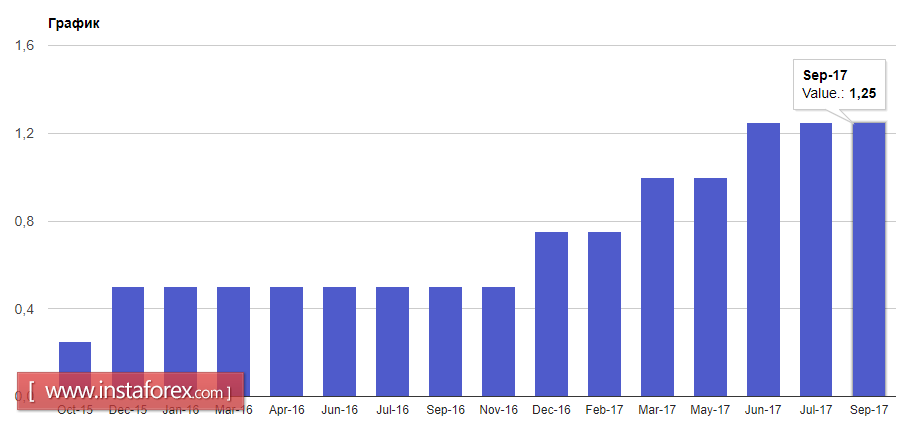

Today is the second day of the next meeting of the Fed, which is devoted to talk about monetary policy. The decision for the interest rate will be published in the middle of the North American session, which is expected by most economists to remain unchanged at 1.25%.

More importantly, the traders' attention will be focused on the report of the Federal Reserve System, whose representatives said last month that they plan to raise the key rate again by the end of 2017. If such statements are made today, the demand for the US dollar will grow substantially.

A slight pressure on the US dollar was created due to the probable appointment of US President Donald Trump for the new head of the Fed, Jerome Powell. Powell is seen as a supporter of less aggressive tightening of monetary policy, which could affect the committee's new decisions as early as next year.

As for the technical picture of the EUR/USD pair, it remained unchanged compared to the forecasts announced earlier this week. The key resistance remains at 1.1680, the rebound from which will lead to a larger selling of the euro in the area of 1.1560 and 1.1520.

* The presented market analysis is informative and does not constitute a guide to the transaction.