AUD / USD overview with current day forecast

Since January last year, the main pair of the Australian dollar is shifting upward which corrects the previous powerful stage of decline.The potential price increase was minimal that makes the nature of the movement predominantly flat. The calculated target area is located near the lowest possible level of completion.

The vector of short-term fluctuations in the pair's price is set by a bearish wave since the end of July. It clearly traces the inner zigzag. The wave has insufficient momentum to change the direction of the trend. Although, the price has reached the preliminary target zone. The chance to change the direction of the inter-day trend is very high.

Today, the decline is expected to end and shift to the upward movement which is already starting. The Short-term pressure on the support zone will still persist in the next session.

Boundaries of resistance zones:

- 0.7740 / 70

Boundaries of support zones:

- 0.7650 / 20

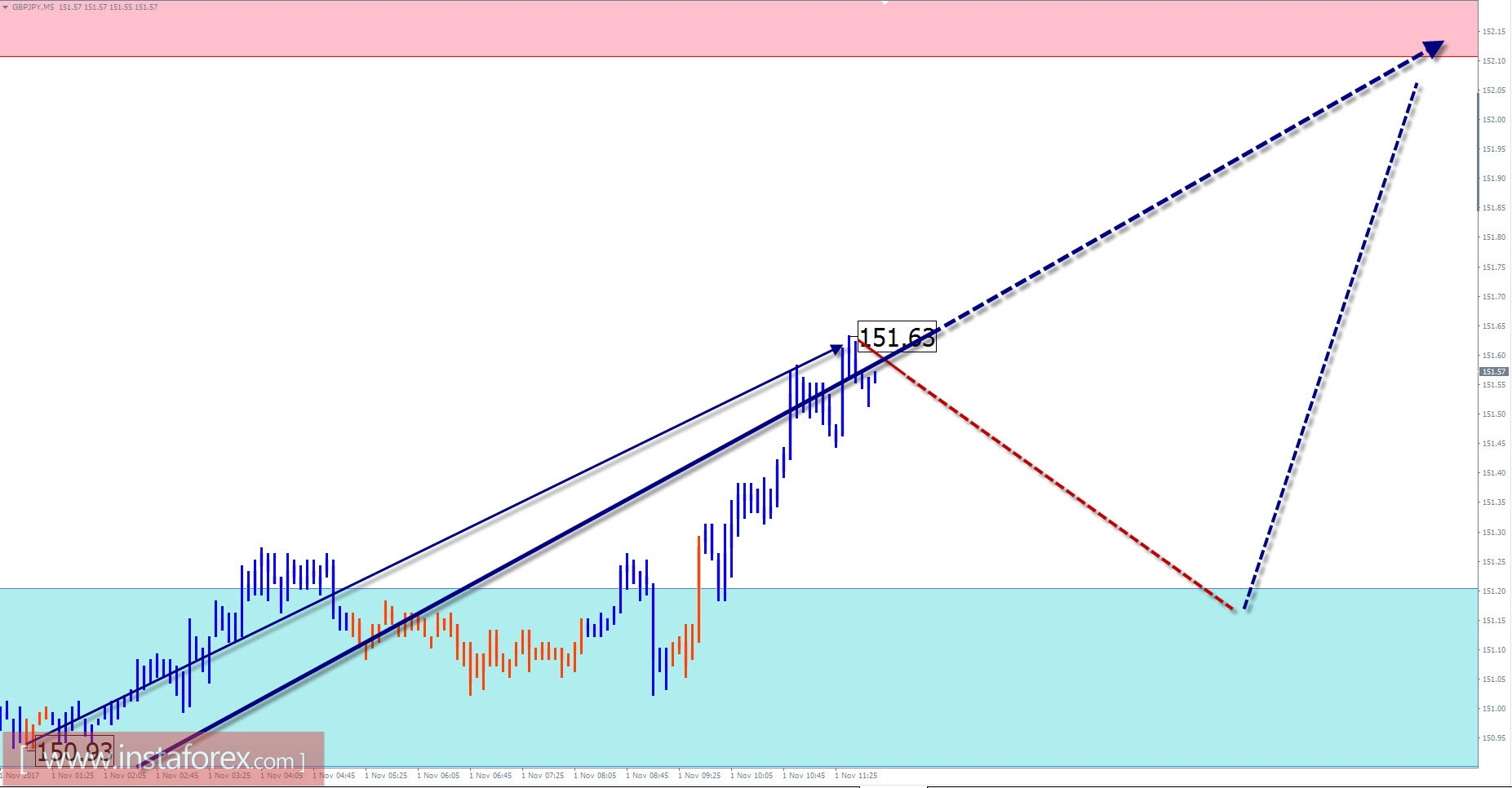

GBP / JPY outlook for the current day

Quotations in the cross pair of the British pound against the Japanese yen attained the lower limit in a wider potential reversal zone. The proportions of all parts of the wave have been met and the preliminary lifting targets are achieved.

The chart has been developing a downward wave since the middle of September. At its wave level, it can claim the place of the reversal pattern for a bit, prior to the change in the direction of the short-term trend. The middle part of the wave in the last three weeks has reached the minimum level of elongation from which a turn is already possible. In this case, the most likely scenario is the return of the price before changing the rate to the level of the beginning of the whole wave.

The upward trend will most likely to continue today. In the next sessions, the lateral flat tone is not excluded and the activation of the pair is expected at the end of the day.

Boundaries of resistance zones:

- 152.10 / 40

Boundaries of support zones:

- 151.20 / 150.90

Explanations to the figures: For simplified wave analysis, a simple waveform is used that combines 3 parts namely A, B, and C. All types of correction are created and most of the impulses can be found in these waves. Every time frame is considered and the last incomplete wave is analyzed.

The areas marked on the graphs indicate the probability of a change in the direction of motion has significantly increased as calculated in the areas. Arrows indicate the wave counting following the technique used by the author. A solid background of the arrows signifying the structure has been formed while the dotted one means the expected wave motion.

Attention: The wave algorithm does not take into account the duration of the movement of tools in time. The forecast is not a trading signal! To conduct a bargain, you need to confirm the signals used by your trading systems.