EUR / USD, GBP / USD

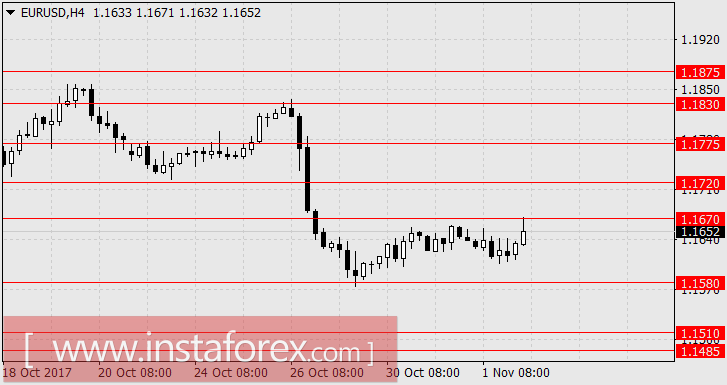

According to yesterday's result, the single European currency and the British pound declined on the positive data, as the US private-sector job growth in October increased from 110 thousand to 235 thousand against the forecast around 200 thousand. The September index was revised down from 135 thousand. The mood for Friday's nonfarm shows its forecast of 311 thousand. The decision was released by the FOMC FRS in the evening appeared to be neutral-positive with the hurricanes was insignificant. In other words, it will not affect the regulator's decision. Construction costs in September increased by 0.3% against expectations of 0.1%, while the ISM Manufacturing PMI for October fell from 60.8 to 58.7,

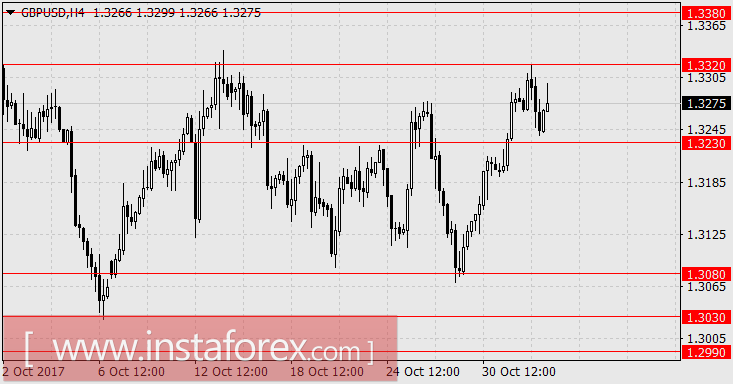

In the UK, Manufacturing PMI for October showed an increase from 56.0 to 56.3, while the house price index increased by 0.2%, but the data could not significantly affect the exchange rate of the national currency. The markets were able to cheer up today in the course of the Asian session, in anticipation of the hike by the Bank of England (12:00 London) from 0.25% to 0.50%, showing a balance of 6-3 votes. At 12:30 London time, Mark Carney will have his speech. It is stated earlier that the rate of increase in the rate of inflation is greater than the normalization rate. This increase can be considered by the market and the growth rate will not happen. Besides, it does not prevent speculators from showing increased volatility in both directions. At the same time, there is a 9.6% chance that the increase will not happen despite the market expectations for a 90.4% rate increase. We are talking about the fact that the decision to raise rates in November abruptly happened.

The slightly important event of the day could be Trump's final decision on the candidacy for the post of Fed chairman. The news labeled that it would be Jerome Powell. Our rating is slightly different, which shows that J. Yellen remains the main candidate, J. Powell takes the second place, and K.Warsh is in the third. But the markets considered all candidates equally well , and the dollar was able to strengthen on any decision by the president.

On the euro area today, final estimates of Manufacturing PMI are coming out for October and changes are not expected, which remained at 58.6. Germany is expected to reduce the number of unemployed by 10 thousand.

We are expecting for the decline of the euro in the range of 1.1485-1.1510. The price of the pound can reach the range of 1.3380-1.3400 as the first reaction to a rate hike, but it is likely to decline to levels 1.3080, 1.3030 in the future.

AUD / USD

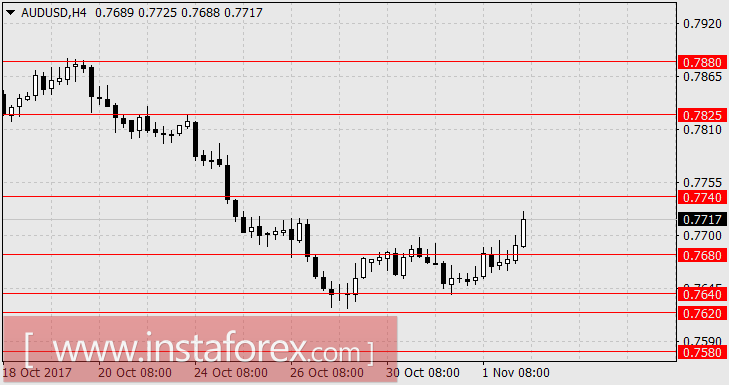

Yesterday, the Australian dollar rallied in the commodity market and increased by 20 points against the weakening of other counter-dollar currencies. This morning, it is already leading in growth by adding 38 points during the Asian session, currently on the mixed dynamics of commodities markets but was under the impression of fresh macroeconomic data. The trade balance in September increased from 0.873 billion dollars to 1.745 billion, with an estimate of $ 1.20 billion. Exports increased by 3.0%, imports remained unchanged (0.0%). Construction permits in September were issued by 1.5% more than in August. The September retail sales will come out tomorrow , with an anticipated increase of 0.4% after the previous compression by 0.6%.

However, optimism was short-lived. Iron ore prices have already turned down and some non-ferrous metals also refuse to grow. While yields on Australian government bonds are falling throughout the range, as the 5-year-olds declined from 2.212% to 2.18%. The "Australian" became dependent again on the US dollar, hence, everything will depend on its dynamics upon the announcement of Trump for the next Fed chairman. Since we are waiting for the dollar strengthening based on news, respectively, we are expecting for the decline of AUD / USD pair in the range of 0.7620 / 40 and further to 0.7580.

* The presented market analysis is informative and does not constitute a guide to the transaction.